In the year of the Platinum Jubilee, ABBA making a (virtual) come back, and a very festive World-Cup, Pandle has undergone its own mini transformation.

As you’re probably aware by now, we’re enthusiastic about making bookkeeping as simple as possible. We understand just how busy it can be running a business, and the last thing you want to do when you get home is spend hours on your bookkeeping. Life is for living!

Our developers have worked extremely hard this year, so we wanted to remind you of some of the key improvements and updates going on at Pandle HQ this year.

An easier way to track mileage

Our brand-new feature for easily recording business mileage was our most exciting new addition to the Pandle family this year.

Mileage Tracker makes logging the details of every business journey much easier, so you can automatically work out mileage claims at the touch of a button.

Record your journey in real-time, or enter the start and end points when you’re ready, and Pandle will track your business miles as a mileage cost in your bookkeeping, using the correct rate for your vehicle.

Now all you need to worry about is which podcast to listen to on your drive!

Helping you save more time for the things that matter

Nobody wants to spend hours on their bookkeeping, which is why we’re so passionate about providing features which make your life easier. For instance, our time-saving tools for entering banking transactions without all the typing.

But at Pandle HQ we don’t just do easy, we do easy-peasy-lemon-squeezy.

With that in mind, we’ve been busy introducing a whole host of improvements to our banking features.

It’s now easier to identify which Bank Rule confirmed a transaction, so you can set processing rules, auto-confirm payments, and see what’s happening with your transactions quicker than ever before.

Because everyone hates spending time on repetitive, monotonous tasks, you can also confirm transactions and imports in bulk rather than individually

It makes the process much more efficient, and that’s always a win. Say goodbye to the days of clicking away whilst staring into space (or out the window, whichever you prefer).

But then to really rev things up, we took our banking updates one step further.

- Click on the notification which tells you when a Bank Feed has refreshed, and you’ll be taken straight to your confirmation screen ready to take care of any transactions not managed by your Bank Rules.

- Pandle will automatically mark imported transactions as checked as long as all the required fields are selected. All you’ll need to do is confirm them, and decide what to do with the extra time.

- If you assign tax codes to each category, Pandle will use this information to automatically populate tax codes when importing your invoices.

You could say we’ve gone automation mad this year.

Improving the user experience

One of our projects this year was to make your bookkeeping more visible, so that you can always see exactly what’s going on.

If you’re using a smaller screen to access your data, Pandle now automatically scales the column width to remove empty space and prioritise key information, leaving more room for the data that matters.

For instance, reducing the ‘Description’ column to give the ‘Transaction Type’ column more space.

Fast, stable bookkeeping when you need it most

Losing out on Beyonce tickets because everyone went online at once is one thing, but when it comes to your business’ finances, we want to make sure your bookkeeping is always accessible. That time-out screen won’t appear on our watch.

Our autoscaling improvements mean that Pandle will now detect particularly high usage, and automatically connect new servers to keep everyone’s show on the road. Then, once demand reduces again, Pandle will shut those servers down to avoid wasting power.

Reducing the risk of errors in your bookkeeping

If you’re reading this, we’re mostly sure you’re human, and of course, humans make mistakes! Bookkeeping errors can be costly though, and that’s always something we want to help you avoid.

This year we introduced lots of new updates to further the reduce the chances of this happening.

Minimising currency errors in Bank Feeds

When you connect Pandle to your bank account, you’ll be asked to confirm which currency it uses.

Our update to prevent currency errors in your Bank Feeds means that if you select a Bank Feed in a different currency to the one set up in Pandle, the option to save the feed connection will be locked, and the currency will automatically change to the bank account you’ve selected.

We also made some changes to the currency calculation process and how this is recorded in your bookkeeping, so there’s much more clarity on currency conversions!

The fight against errors doesn’t stop there…

Protecting you from the risk of VAT errors

This year we also introduced additional measures to help reduce VAT registration errors in Pandle.

As a new user you’ll be asked a series of questions to help ensure your account is set up correctly. If you tick to confirm that your business is VAT registered, Pandle will respond dynamically to show you the sections you need to complete.

Our algorithm will then work in the background to keep a careful eye out for anything that looks a bit strange, like if the start of a VAT scheme is before the VAT registration date.

Pandle also has registration date locking to help businesses on the VAT Flat Rate Scheme avoid problems if they accidentally use the first-year discount for longer than they should.

Keeping you more organised than ever (without all the typing)

If your New Year’s Resolution is to be more organised – we’ve got your back.

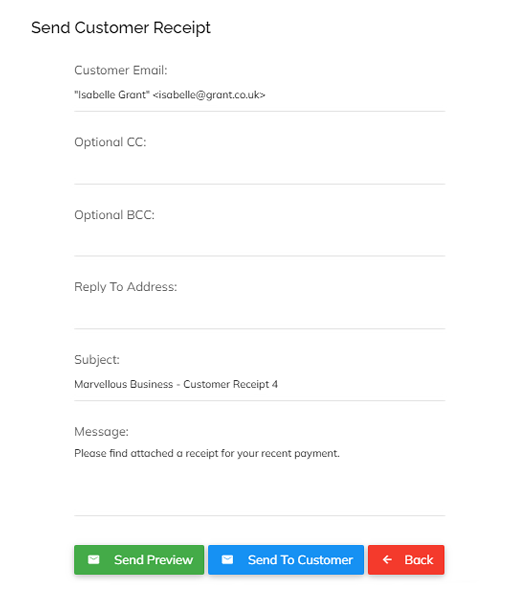

Stay on top of your bookkeeping while your business flourishes by sending customer receipts for proof of payment.

Once you enter or confirm a customer’s transaction payment, you can now use this information to create a new Customer Payment Receipt and send it directly to them.

Just hit ‘Email Receipt’ and chose the payment you’d like to send confirmation for.

Accounting for overpayments in your bookkeeping is also more efficient, helping everyone keep track of where their payments are up to (and helping you keep your customers happy).

Keep on top of supplier invoices

If you regularly work with the same suppliers, then they might invoice you for the same items on a regular basis too. So that you don’t need to spend time entering the same information over and over, we added a copy invoice tool.

It’s as simple as finding the invoice you’d like to copy, clicking ‘More’, and selecting ‘Copy Invoice’.

So, sit back, relax, and enjoy your extra time!

Include projects when importing customer and supplier invoices

Pandle Projects lets you organise your transactions, notes, and attachments according to every job you take on. Now you can include the project name when you import customer or supplier invoices, making it even easier to link your invoices and projects together without so much typing.

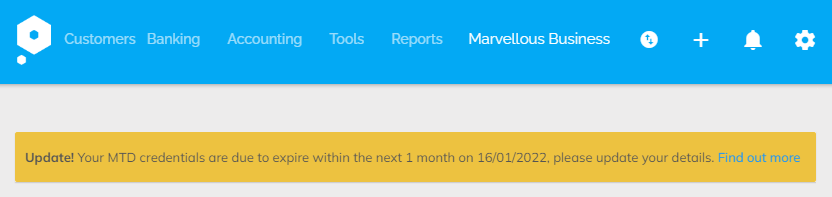

Reauthorisation reminders for MTD

With all the new rules coming into place, it seems like Making Tax Digital is all the rage at the moment.

If you’re too busy to keep track of when you need to reauthorise Pandle for MTD, there’s no need to worry. Pandle will show you a series of notifications, starting exactly one month before the expiry date, giving you plenty of time to reauthorise MTD, or to get help from our team if needed.

Well, what a year it’s been! Here’s to a great 2023. Happy New Year everyone!

Want to know more? Take Pandle for a test drive and create a free account today.