Unlike some of the outfits you might be sporting in old photos, reliable, accurate bookkeeping never goes out of fashion. But it’s not just clothing tastes that change over time. Currency conversion rates fluctuate constantly, which can impact your bookkeeping figures if you’re invoicing across borders.

It’s why Pandle includes our Multiple Currencies tool, to help make things easier. But of course, we always want bookkeeping to be as simple as possible, with fewer chances of making mistakes so we wanted to make sure this feature was the best version of itself.

In our latest update we’ve improved the currency calculation process in Pandle to make sure that the currency conversion rate always matches if the dates are changed. Step away from the Hawaiian shirt, and let’s talk business.

Bookkeepers without borders

When you select your base currency in Pandle all your invoicing and banking will default to using that currency, but that doesn’t mean you’re stuck in one place. Our multiple currencies feature is built into Pandle’s free plan, and will automate any currency conversions using the latest rates, at no additional charge.

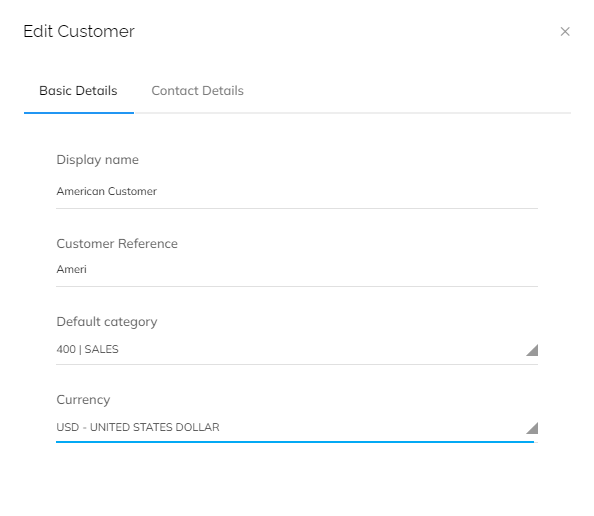

All you need to do is select the billing currency when you create or edit a customer (for this to show, you’ll need to enable multiple currencies in your company settings on Pandle). The same applies to managing your suppliers or creating a bank account in Pandle with the correct base currency.

Making sure your currencies are current

Pandle will use the currency conversion rate that was correct at the time of the transaction, just to make sure nobody gets any surprises, and that your bookkeeping is accurate as possible. For instance, if you create a new customer invoice, Pandle will use the exchange rate on the date of the invoice, rather than the date you create the invoice.

Thanks to our latest update, this thought process will also apply to viewing your Categories table in Pandle. So, as well as seeing a category for that currency, you’ll now also see a category which shows the gain or loss exchange.

A gain or a loss happens when an exchange rate changes between the time an invoice is issued and when it is paid.

For example, if your business normally uses British Pounds (GBP), and you have a transaction in US Dollars (USD). When you view your categories table in Pandle, the gain/loss category obviously won’t include any transactions which are dated after the end of the date range that you’re looking at.

When you view a date range which includes those transactions, the gain/loss category will show any gains or losses that happened as a result of the currency exchange rate changing between the date the invoice was created, and the date the invoice was paid.

That way, you’ll have a more accurate overview of what’s happening in your business’s finances, whilst keeping everything accurate. It’s a classic which is never going out of fashion.

Learn more about Pandle’s time-saving bookkeeping tools and features, and create your free account.