Have you ever noticed the way that far-off deadlines suddenly speed up their approach when you’re not looking? They can be quite sneaky like that. When important dates seem like a problem for future you, it’s all too easy to put things off, forget all about them, and then be left scrambling at the last minute.

OK, so we might not be able to help with your exam revision or wedding speech, but we can help you make sure your VAT submissions go as smoothly as possible.

As well as timesaving, error reducing bookkeeping tools to get your figures ready, Pandle’s latest update means you’ll now have plenty of notice when it’s time to reauthorise MTD. Adios, frustrating delays!

What is MTD reauthorisation?

Making Tax Digital sets out to make the process of recording and submitting tax information easier. So far, the scheme has rolled-out to VAT registered businesses which are now required to keep digital bookkeeping records and use compatible software (like Pandle) to make VAT submissions to HMRC.

To protect your data, you’ll need to authorise the connection between the software you use and your Government Gateway account, and then reauthorise it every 18 months after that. That seems like quite a long time, doesn’t it?

A lot can happen in 18 months, especially when you’re running a business, and it’s all too easy for some things to pass you by. So, imagine signing into Pandle to submit your VAT return, only to be delayed because you missed the reauthorisation deadline? Fear not, because that’s exactly the sort of the thing we can help you avoid.

Reminder notifications to re-authorise your MTD connection

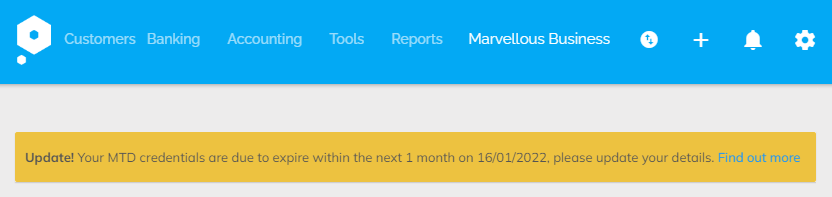

Our latest update means you’ll now see a reminder to re-authorise Pandle for MTD a month before the expiry date. The notification will appear across your dashboard when you sign into Pandle. If you’re not sure what to do next, just click the banner to read our guide to reauthorisation, or use our Live Chat to talk to one of Pandle’s team of bookkeepers.

If you’re in a rush to look at something else, you can dismiss the notification, and it will keep reappearing each time you return to the dashboard until you update your MTD connection.

That way you won’t lose track of things, helping to reduce the risk of any frustrating delays when submitting your VAT return, and leaving more time to get on with your to-do list.

Learn more about Pandle’s time-saving bookkeeping tools and features, and create your free account.