If your business is registered for the VAT Flat Rate Scheme, the way you work out your VAT bill is a bit different to the standard accounting method for VAT. You’ll still charge VAT on your sales to customers, and pay it on purchases from your suppliers.

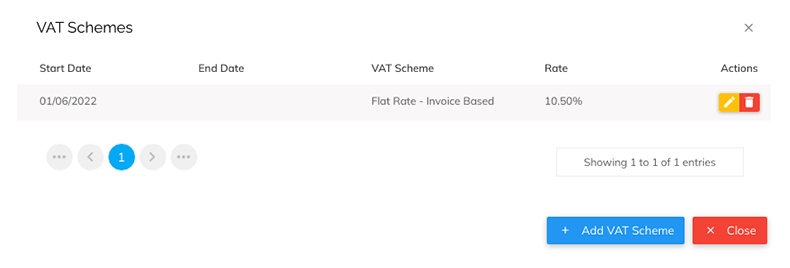

But then, rather than calculating the difference between the VAT on those sales and purchases, you’ll pay HMRC a flat rate percentage of all your taxable sales. The rate depends on what type of business you run. For instance, a business offering computer repair services pays a flat rate of 10.5%.

So why the VAT accounting lesson? Well, when you’re in your first year of VAT registration, you’ll get a 1% discount – which is where our latest update steps in to help reduce the risk of any errors.

Nobody wants those popping up in their VAT return after all!

Protecting the VAT registration date for Flat Rate Scheme users

We’re always looking at ways we can help VAT–registered businesses minimise mistakes in their MTD VAT records. Our latest update helps those using the VAT Flat Rate Scheme manage the risk of accidentally using their 1% discount for longer than they should.

After all, running a business probably means you have another 456,234,453 deadlines to remember already. Which is why we like to make things as simple as possible.

When you set up your VAT scheme in Pandle, the 1% discount you’re entitled to for the first 12 months of registration is worked out automatically.

Just enter the correct flat rate for your business when you set up the scheme, and let Pandle take care of the discount.

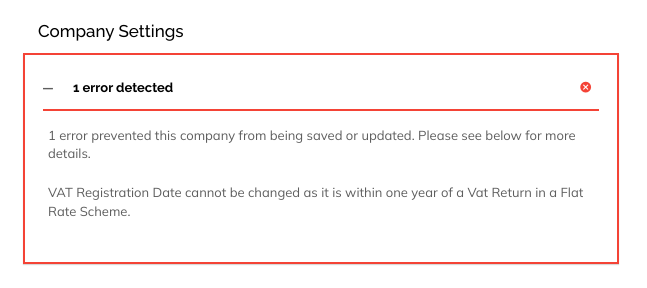

Our new update takes this a step further, so if you have an existing VAT return under a Flat Rate Scheme, you won’t be able to change the VAT registration date.

If you do try to update the registration date, Pandle will show a notification message, so you know what’s going on.

That way you won’t accidentally extend the discount period, risk a VAT return disaster, and annoy the tax collector all in one go.

Learn more about Pandle’s time-saving bookkeeping tools and features, and create your free account.