The domestic reverse charge must be used for VAT-registered businesses in the Construction Industry Scheme (CIS). Rather than the supplier, it will be up to the end-customer who purchases the construction services or materials to account for the VAT themselves.

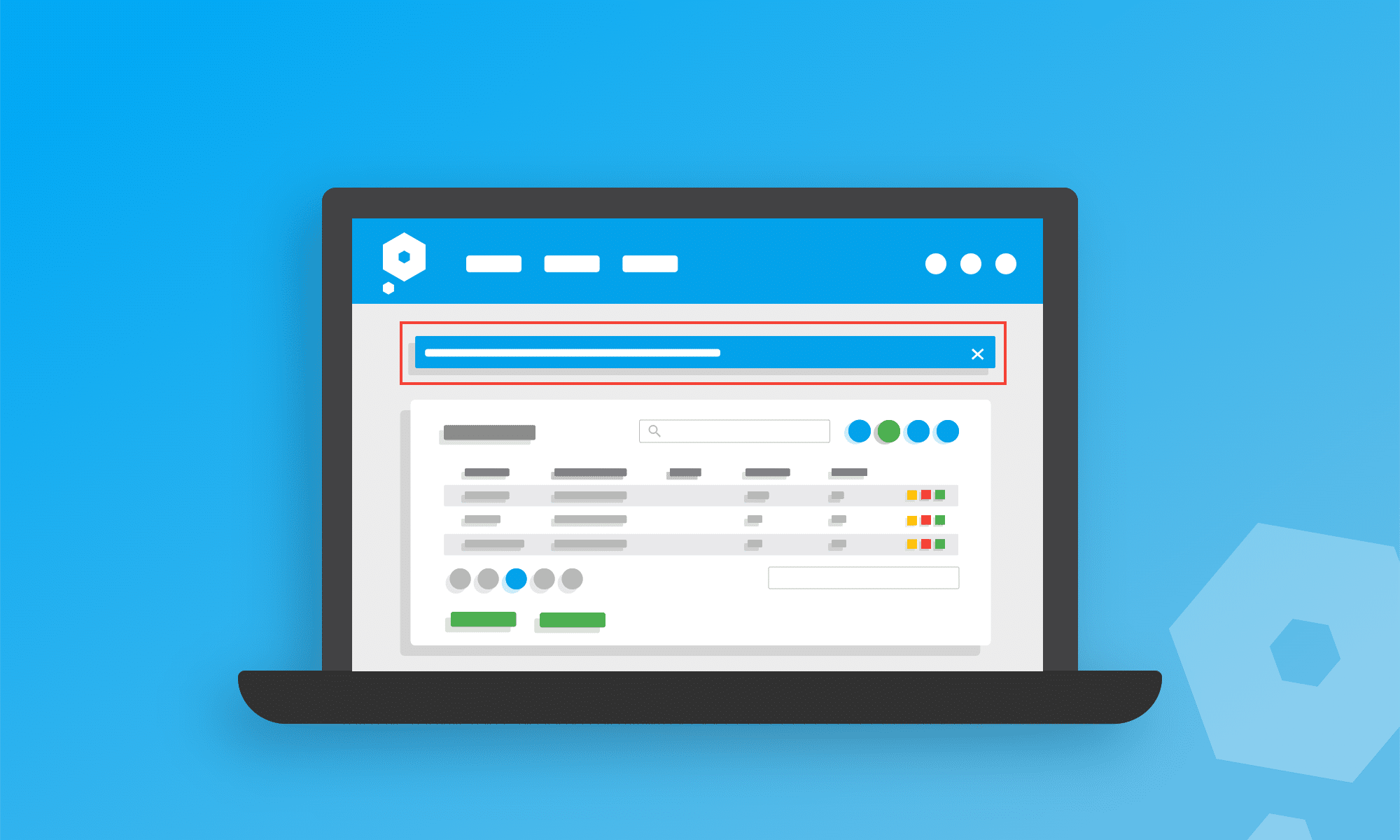

This changes the way that suppliers charge and account for VAT on their invoices, so we’ve released some updates in Pandle to help you ensure your bookkeeping and VAT returns are accurate!