Dividends

Shareholders

Paying Dividends from a Limited Company

Latest Posts By:

I'm fully AAT qualified, with a passion for straightforward bookkeeping. In my spare time you'll find me using my Everton season ticket.

5 mins

Dividends

Shareholders

Paying Dividends from a Limited Company

5 mins

Making Tax Digital

Landlords

How Does Making Tax Digital Affect Landlords?

6 mins

Advice

Sole Traders

Partnerships

Bookkeeping for Sole Traders: How to Create Records for your Tax Return

3 mins

Making Tax Digital

MTD for VAT

The Points-Based Penalty System for MTD VAT

7 mins

Invoicing

What’s the Difference Between an Invoice and a Receipt?

3 mins

Software & Cloud

Switching to Pandle: A Clear Books Alternative

2 mins

Software & Cloud

Switching to Pandle: A KashFlow Alternative

6 mins

PAYE & Payroll

How Do I Pay a New Employee?

5 mins

Limited Company

Our Guide to Corporation Tax

7 mins

VAT Schemes

Which VAT Scheme Should I Use?

7 mins

Registering for VAT

How Do I Register for VAT?

6 mins

Reports

How Do Businesses Use Profit and Loss Reports?

4 mins

VAT

How Do I Make a VAT Submission?

5 mins

Pandle News

Pandle Update: Mileage Tracker – Our New Feature for Capturing and Recording Business Mileage

7 mins

Starting a Business

Limited Company

How Do I Start My Own Limited Company?

4 mins

Business News

Using the Government’s Help to Grow Scheme for your Business

8 mins

Reliefs & Allowances

Expenses

Claiming Self-Employed Tax Relief and Allowances

3 mins

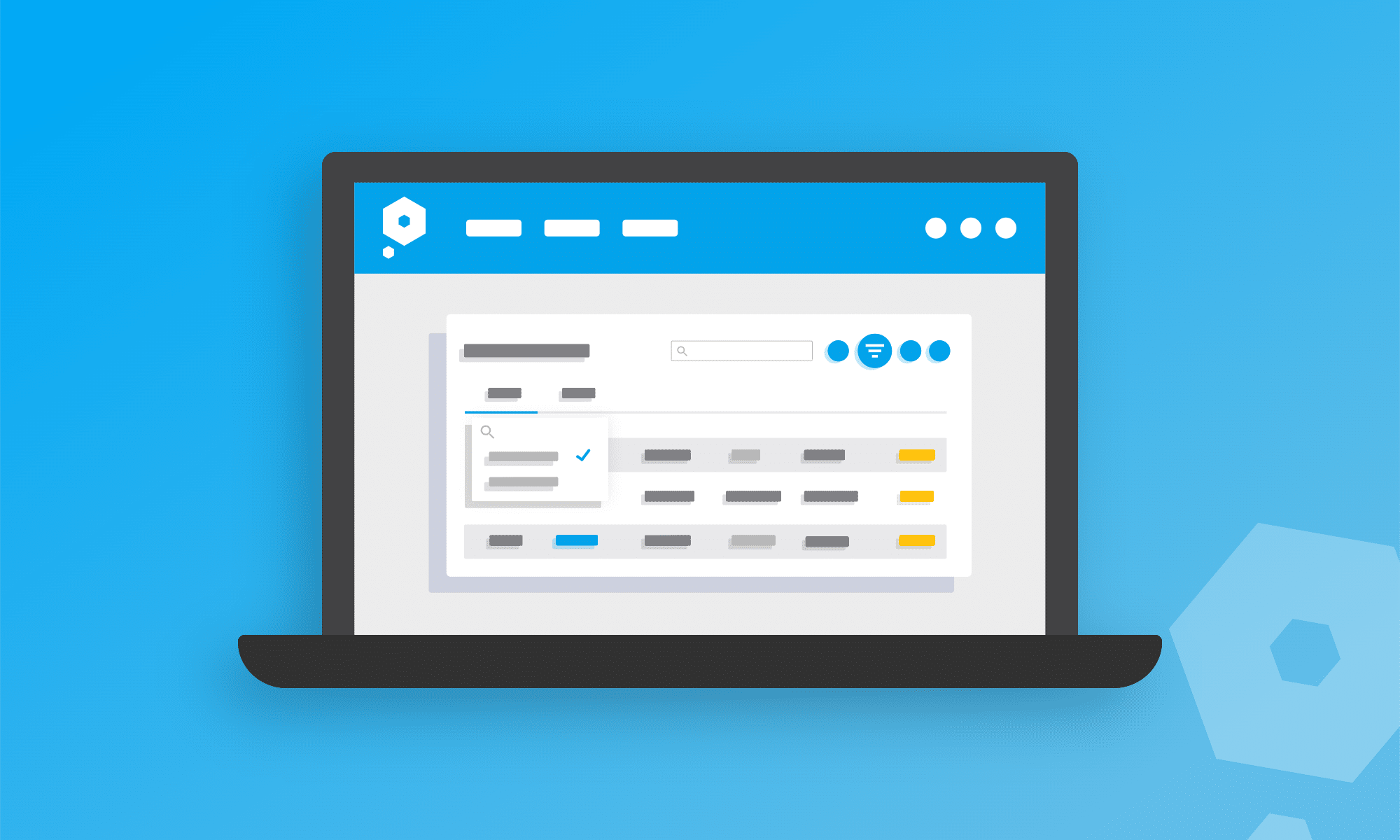

Pandle News

Pandle Update: Filter Stock Items by Balance and Project

4 mins

Pandle News

Pandle Update: New Data Validation Check for Opening Balances

3 mins

Pandle News

Pandle Update: Matching Imported Invoices to Items

3 mins

Pandle News

Pandle Update: Applying the Domestic Reverse Charge

6 mins

Helping Clients

Minimising Client Accounting Errors

5 mins

Bookkeeping & Accounting

How Can I Manage Documents to Make Tax Returns Easier?

3 mins

Self Assessment

The Benefits of Submitting Self Assessment Sooner Rather than Later

4 mins

Advice

Freelancing

Simple Bookkeeping for Freelancers

3 mins

Pandle News

What Can Pandle Do for Accountants?

5 mins

Pandle News

Pandle Update: Direct Bank Feeds

3 mins

MTD for VAT

Making Tax Digital

MTD for VAT

Features

Small Businesses

Accountants

Resources

Pandle is an agent of Plaid Financial Ltd., an authorised payment institution regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference Number: 804718). Plaid provides you with regulated account information services through Pandle as its agent.