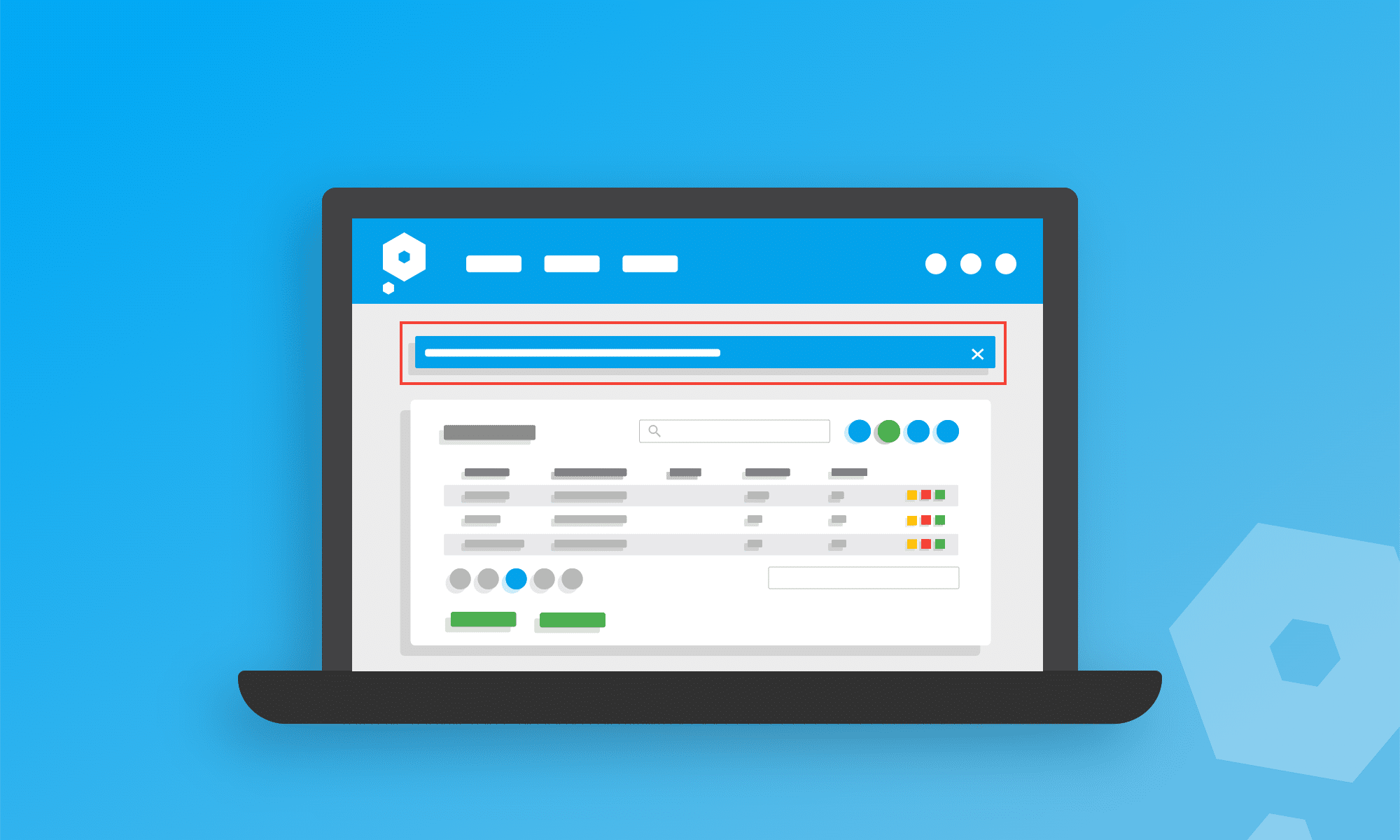

Our cloud-based software, Pandle, allows users to collate transactions and import data easily, using automated Bank Feeds. This effectively stores data all in one place, so you can access all of your transactions at once, from any device, whenever, wherever.

But we haven’t just stopped there.