When you’ve gone through all the hard work of getting a client’s accounts just right, the last thing you want is for them to go in and make changes. We know what a headache this can be!

Our Pandle Partners can already lock transactions for a set date range, such as after a VAT return, or on completion (or in progress) of an accounting period. But, at the moment, our Partner’s clients can then sign in to Pandle and unlock them again.

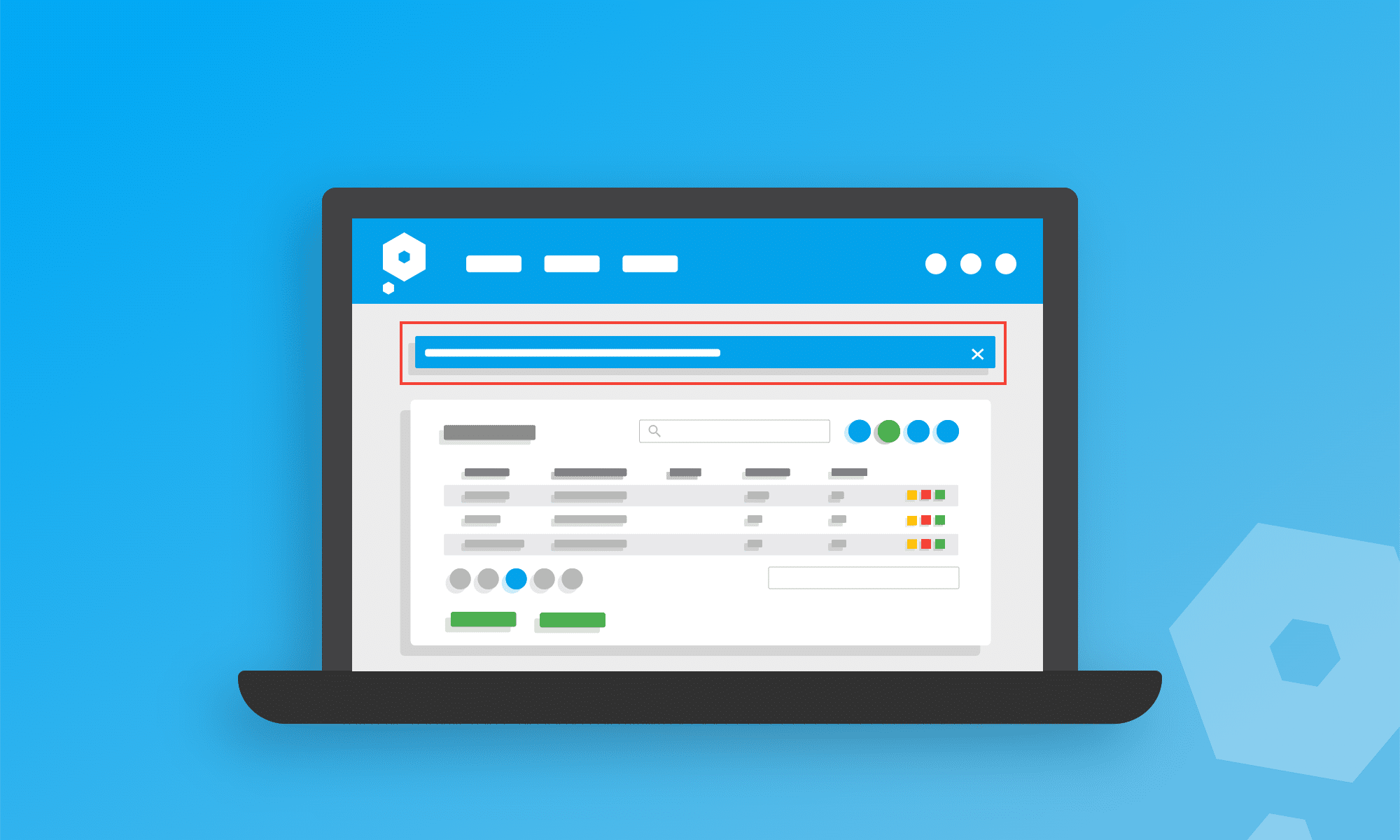

We know what weird and wonderful mistakes can follow on from this, so now we’ve added an extra tick box for accountants to stay in control of who can lock and unlock transactions.

It means that if a client does try to get in and make changes to completed work, they’ll see a message directing them to their accountant. At which point our Partners will now be able to have a chat with their clients about why it might be a bad idea.

We’ve left the power in the hands of our Pandle Partners so they can still unlock those transactions to give them access, if they need to.