Managing your bookkeeping can be confusing, especially when it comes to understanding the ever-changing tax rules. It’s why everyone at Pandle is always striving to make our accounting software as simple and straightforward as possible.

After our recent updates following the end of the Brexit transition period, and further enhancements to the Pandle user experience, we’re back once again, this time with an update to reduce the risk of errors when choosing tax codes. Get the kettle on, and we’ll take the tour.

Seeing the right tax codes, at the right time

Different rules and processes can apply depending on the location of your business, where your customers and suppliers are, and even the sort of work you do. I know, it can get pretty confusing, which is why we are doing everything we can to help!

For instance, the recent Brexit changes affect EU tax codes, whilst new rules for VAT registered Construction Industry Scheme (CIS) businesses mean there’s the Domestic Reverse Charge to consider too.

To make it easier for you to select the right tax codes from an ever expanding range of options, Pandle will now only show the codes which are relevant to you, based on the settings you selected when creating your account and adding new customers or suppliers.

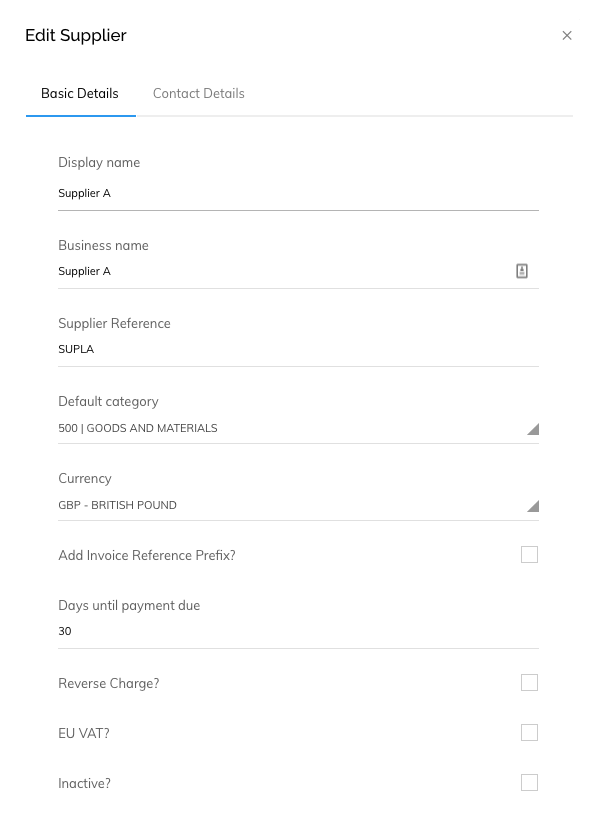

You can enable the Reverse Charge tax code, as well as the EU VAT codes, for customers or suppliers by selecting the appropriate tick box when creating or editing customer/supplier details in Pandle.

The RC tax code

If you set up a customer or supplier and don’t enable the RC tax code for them, this option won’t be available when you’re creating invoices for them.

In fact, the RC tax code won’t be displayed as an option at all, until you select a customer or supplier who also has the Reverse Charge enabled. That way, there’s less risk of accidentally applying it to the wrong invoices.

What about EU tax codes?

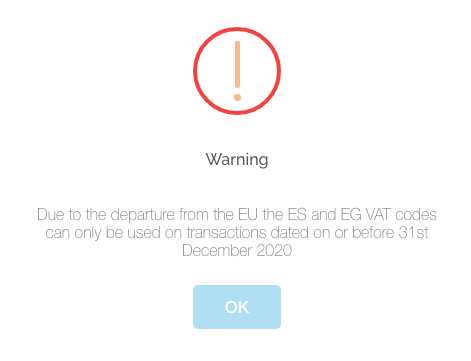

It works the same way for EU tax codes, too. Pandle will only show these tax codes once you select a customer or supplier that has EU VAT enabled, and then only if it applies to the location you provide in your Company Settings.

If your business is in Great Britain (England, Scotland, Wales)

- Pandle’s ES (European Services) and EG (for European Goods) codes can’t be used for transactions dated on or after 1st January 2021. This is because goods and services moving between GB and Europe are no longer covered by EU VAT rules.

Even if you enable EU VAT for a customer or supplier, you’ll see a warning message that the ES and EG tax codes can only be used on transactions dated before 31st December 2020.

If your business is in Northern Ireland

- ES (European Services) tax codes can no longer be used for transactions dated on or after 1st January 2021.

- EG (European Goods) tax codes can still be used as normal with EU member states.

If you ever need help working it all out, just contact our team of bookkeepers using the live chat support tool, or visit our Help Centre for guidance. Entering transactions for bank transfers

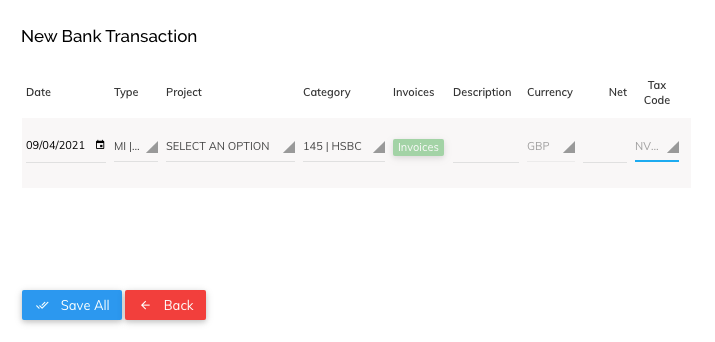

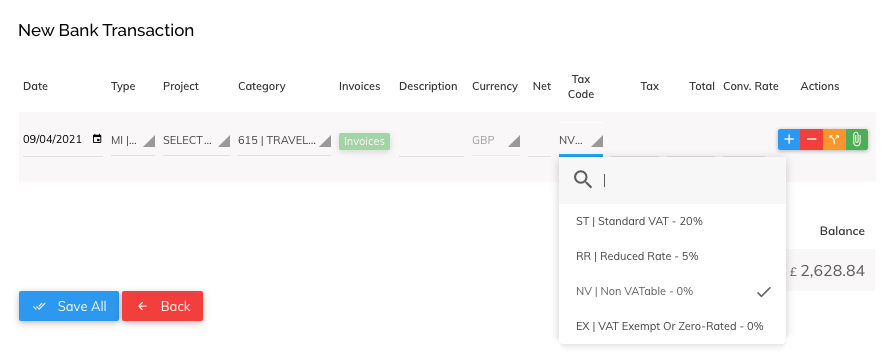

To make it even easier to enter transactions into Pandle, we’ve disabled the tax code field when entering bank transfers, because these don’t need to be selected. Instead, Pandle will pre-populate the field as ‘NV’ to show no tax is included, if you enter transactions which show a transfer between your bank accounts.

Otherwise, Pandle will show you the relevant tax codes in the dropdown menu selector as normal.

That way you can enter information quicker, and with less risk of making mistakes in your bookkeeping. Which, if you haven’t noticed yet, is a BIG thing round these parts.

Learn more about our timesaving, straightforward bookkeeping tools, or create your free account to get started.