Following the end of the Brexit transition period on 31st December 2020 there are new rules for businesses buying and selling goods and services across the UK border.

The arrangements depend on whether your business is registered in Great Britain (England, Scotland, Wales) or in Northern Ireland. Northern Ireland is part of the UK, but has slightly different agreements with the EU.

What does the end of the transition period mean for my bookkeeping?

Because this means that some VAT rules have changed, it’s important that the changes are reflected in your business’s bookkeeping.

We’re all about that accurate bookkeeping here at Pandle HQ, so we’ve made some adjustments to help everything stay on track.

Why have we done this?

Different rules apply depending on the location of your company, so selecting the correct country information enables Pandle to apply the right protocols and calculations.

It also makes it easier for you to complete your bookkeeping accurately. Pandle tailors your settings according to location, so you only need to see options which are relevant to your country’s rules.

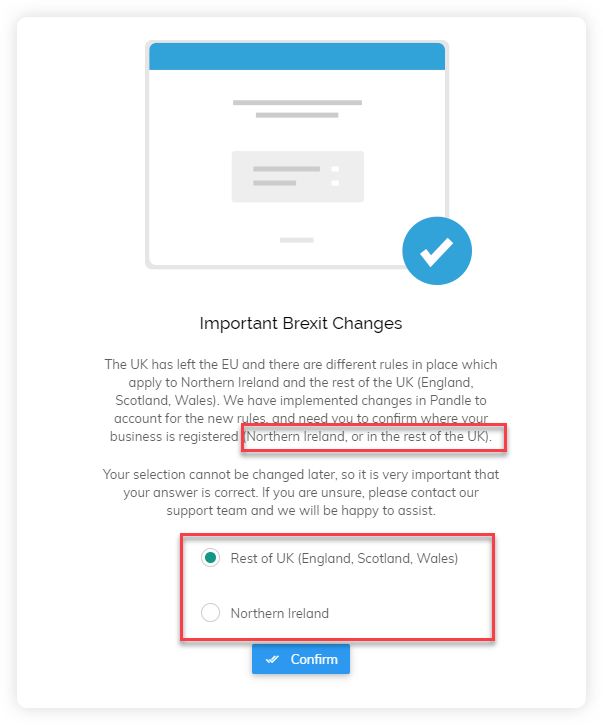

How do I select the correct location?

In some cases, Pandle already knows where a company is located based on the company registration number, and will update your settings automatically.

When this isn’t possible Pandle will show an alert next time you login, and ask for the settings to be updated.

If you login via Pandle Mobile, you’ll be redirected to the Web App to update your information first.

How does this affect what I see in Pandle?

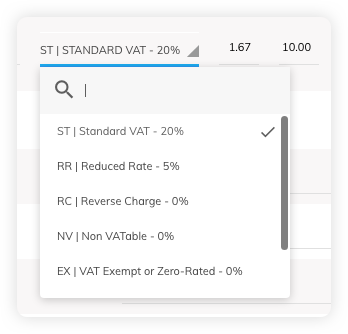

Now that the UK is no longer part of the EU VAT area, some of the rules and processes for VAT have changed, which affects the way we use tax codes in Pandle. We want to make things less confusing by only showing the options relevant to your location.

It might mean the tax code options available to you for creating and editing invoices look a bit different to how they used to. Our help centre explains the changes to VAT in Pandle when trading with Europe in more detail.

Specific changes for Great Britain (England, Scotland, Wales)

- EU tax codes (ES for European Services, and EG for European Goods) can no longer be used for transactions dated on or after 1st January 2021. This is because goods and services moving between GB and Europe are no longer covered by EU VAT rules.

- EC Sales Lists (which are used to report the VAT on sales to the EU) are no longer required. You won’t be able to create an EC Sales list in Pandle for the period starting 1st January 2021 onwards.

Specific Changes for Northern Ireland (United Kingdom)

- ES (European Services) tax codes can no longer be used for transactions dated on or after 1st January 2021.

- EG (European Goods) tax codes can still be used as normal with EU member states.

- EC Sales Lists can still be used, but only for transactions containing EG tax codes.

General Changes

When UK businesses buy or sell from other businesses based in the EU, the VAT is either zero-rated (tax code EX) or a reverse charge (tax code RC).

So that your bookkeeping is in line with the new post-Brexit changes, we’ve added a new tax code to Pandle for Reverse Charge (RC) transactions.

Even though both the EX and reverse charge tax code show 0% VAT, it’s important to select the right one so that your VAT return is accurate!

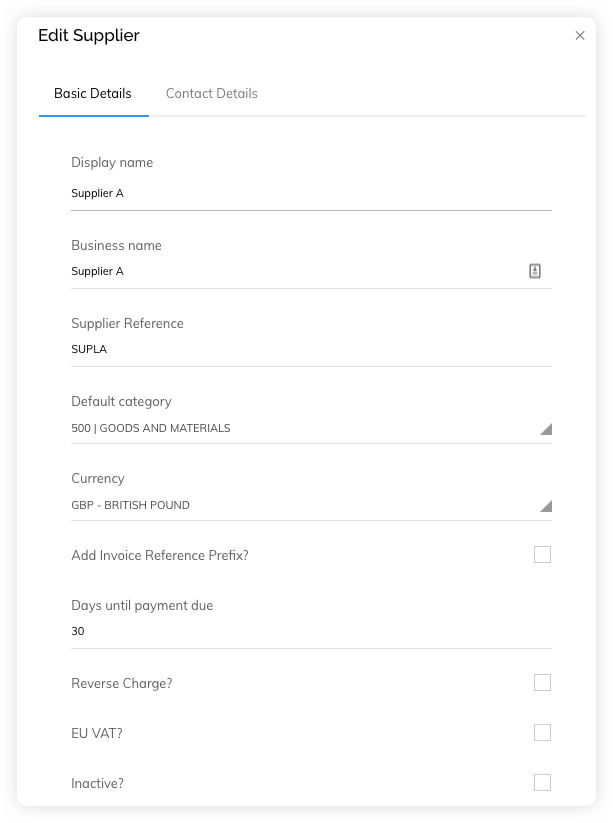

You’ll only be able to use the reverse charge tax code for relevant EU customers or suppliers. Simply select the RC option when creating a new customer or supplier.

To edit existing ones, go to the ‘Customer’ or ‘Supplier’ tabs under ‘Enter Transactions’, and click ‘edit’.

After that, you’ll have the option of selecting the Reverse Charge VAT code when you create new invoices, making things much simpler (and more accurate) down the line. Phew.

Did we mention how much we like making bookkeeping as simple and accurate as possible?

At Pandle HQ we’re passionate about developing and providing tools which make life easier for busy business owners. Create your free account to start exploring.