We know that dealing with your tax affairs can be daunting – and downright confusing. So, as friendly providers of online bookkeeping software, we think it’s our job to help you take care of VAT more easily. Which is precisely what this Pandle update is all about.

We’ve enhanced the Reverse Charge (RC) tax code function in Pandle, so that using it is now more seamless, and with fewer opportunities for errors. Both of which we’re rather fond of.

Applying the Reverse Charge with Pandle

We created the Reverse Charge (RC) tax code in Pandle for users affected by the introduction of the domestic reverse charge for VAT-registered businesses in the Construction Industry Scheme (CIS).

Until now though, you could only enable the RC tax code for individual customers or suppliers. This meant that anyone needing to apply it to everyone they dealt with would have to remember to check that option on every single one. Which, you know, is okay, but it’s just not very Pandle.

So now, if you want to, you can simply enable the Reverse Charge as the default setting in Pandle instead.

Just remember that if you use this setting, the RC (Reverse Charge) VAT code option will be available for every invoice that you create.

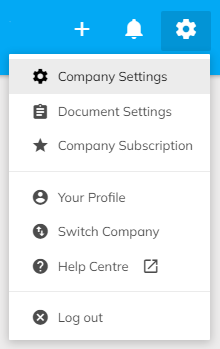

To enable the RC VAT code as a default, open the Pandle menu, and click ‘Company Settings’.

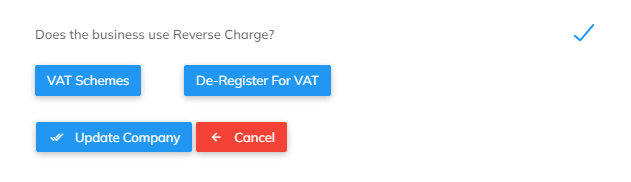

Select the ‘Financial Info’ tab.

Then check the ‘Does the business use Reverse Charge?’ option, and click ‘Update Company’ to enable the setting.

Reducing the risk of RC tax code errors

Even if you enable the RC tax code as your default option, there are still times when selecting it would cause all sorts of strange mistakes in your VAT accounting. Even just writing about it is enough to make us shiver.

Fortunately, there was something we could do.

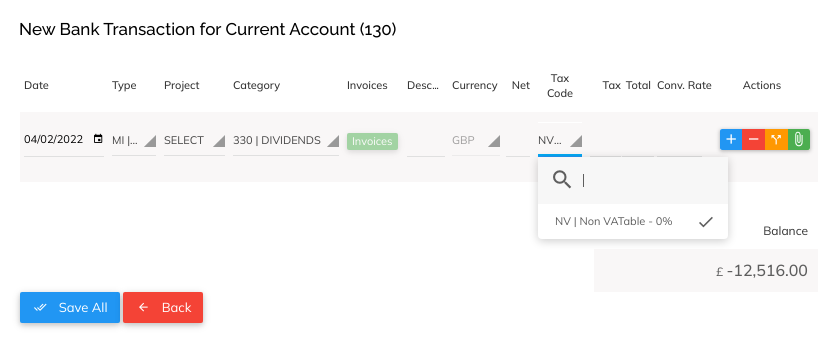

To help you avoid potential tax coding errors, the RC tax code will be unavailable if you select specific categories whilst working in Pandle:

- Equity categories, such as ‘Dividends’ or ‘Profit & Loss’

- Liability categories, such as ‘Accruals’ or ‘Corporation Tax Owed’

- Asset categories which relate to your Bank Accounts

If you select a category within one of these areas, for instance if you’re creating a new supplier invoice or checking bank transactions, then the RC tax code won’t be offered as an option.

That way there’s no danger of selecting it by mistake, and upsetting your VAT return later on! Because if there’s something we like at Pandle, it’s making everything (except mistakes) easier. And VAT’s the end of the matter.

Learn more about our timesaving, straightforward bookkeeping tools, or create your free account to get started.