Despite the recent stormy weather conditions outside, we’ve been busy on our quest to bring smooth sailing to our Partners’ clients’ bookkeeping.

After some extensive testing, we’re now ready to release a new Pandle feature which is designed to help make managing clients’ year end easier for our partner accountants. Say hello to automated year end records requests!

What are automated year end records requests?

Here at Pandle we want to help solve the problems that our Partners face in their practice. We know that getting clients ready for year end can sometimes be a challenge, especially when it comes to making sure their bookkeeping records are up to date and ready for accounts to be produced.

With this new feature, Pandle will ask our partners’ clients if their records are ready for their accountant as soon as they enter transactions which are dated past their year end (and there are no imported bank transactions left to confirm, which are dated before year end).

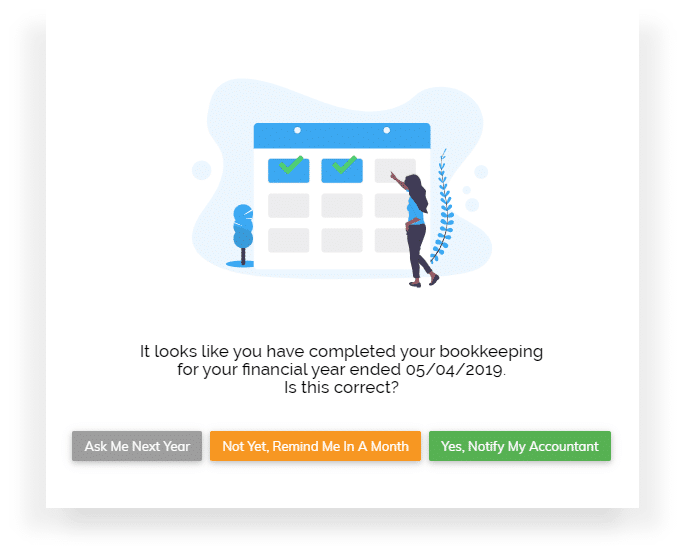

It looks like this…

It’s a little nudge which not only reminds clients to check that all of their records have been completed, but also to let their accountant know they’re ready with a notification email. It’s a win for everyone, giving our partner accountants more breathing room to do the work during quieter periods, and their clients more time to pay their taxes. High-fives all around!

Reducing stress at year end

To help minimise client confusion, Pandle checks the business’s year end date with Companies House, as well as the date that company accounts were last filed. This helps Pandle to avoid asking clients to provide records for periods that have already been submitted.

For sole traders, Pandle will also assume their year end is the 5th April. However, we will shortly be adding the ability to adjust this date if any of our partner accountants have sole trader clients who use a different year end.

The first time that Pandle sends a request, it may be for records that have already been received but not yet submitted to Companies House, or if the client is a sole trader with a year end which is different to the 5th April – just a little something to bear in mind!

If the client informs Pandle that their bookkeeping is not yet ready, the automated request will be sent a further two times, with a month in between each request.

Improving communication between accountants and their clients

We hope this feature will provide our partner accountants with more time to produce and submit their clients’ accounts, reducing stress levels in the process. So now, if a client completes their bookkeeping but forgets to let their accountant know, this feature will help to keep everyone in the loop by sending an email notifying their accountant.

At the moment this feature is only applicable for limited companies, but don’t worry! Clients who are set up in Pandle as sole traders will start to be included in our automated records requests from 6th April 2020. We’re also planning to extend this feature to include VAT returns too, and we’ll let everyone know as soon as it’s ready.

In the meantime, let us know what you think – or get in touch with any questions – by emailing support@pandle.com or talk to one of the team using the Live Chat button on screen.