When it comes to VAT returns, the idea of making mistakes is enough to give anyone that cold and fearful feeling in the pit of their stomach. Which is precisely why we’re here with a new update, like a warm and comforting bowl of porridge for your bookkeeping.

Our latest Pandle release is all about helping to avoid common errors which can cause issues when you come to submit your VAT return. Wrestle your spoon back from Goldilocks, and we’ll tuck right in.

Making MTD VAT submissions with Pandle

Pandle constantly works in the background, using your bookkeeping records to automatically calculate your VAT return with each new transaction.

Our algorithms never sleep, and are constantly checking your data to make sure you claim every possible VAT expense, whilst handling all the calculations for you.

Being Pandle though, we want to do everything we can to iron out potential issues which might cause problems in your VAT returns later on. We’re always looking for improvements which is why, after some careful analysis, we’ve updated the way that Pandle records VAT return end-dates and registration numbers.

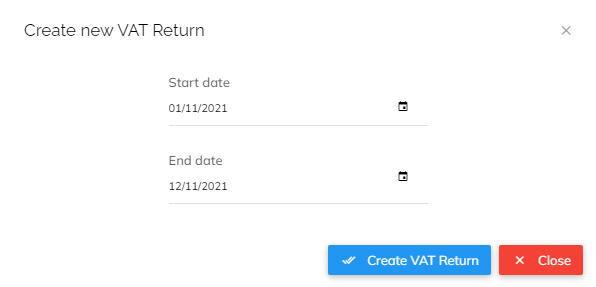

Default settings for your VAT return end date

VAT returns cover a three-month period, so when you create a return in Pandle the period starts the day after your last VAT return, plus three months.

But if you create a VAT return and it covers a time period which ends at some point in the future, that might be a problem. It’s best not to start predicting the future in your VAT return, leave that to Mystic Meg.

To reduce the risk of submitting a VAT return which has invalid dates, Pandle detects if your end date is in the future. But now, rather than just showing you an error message, Pandle will automatically set the end of the period to the current date.

You’ll still see an alert message, just to let you know what’s happening.

And you’ll be able to continue creating your new VAT return, using the current date as the end of your VAT period.

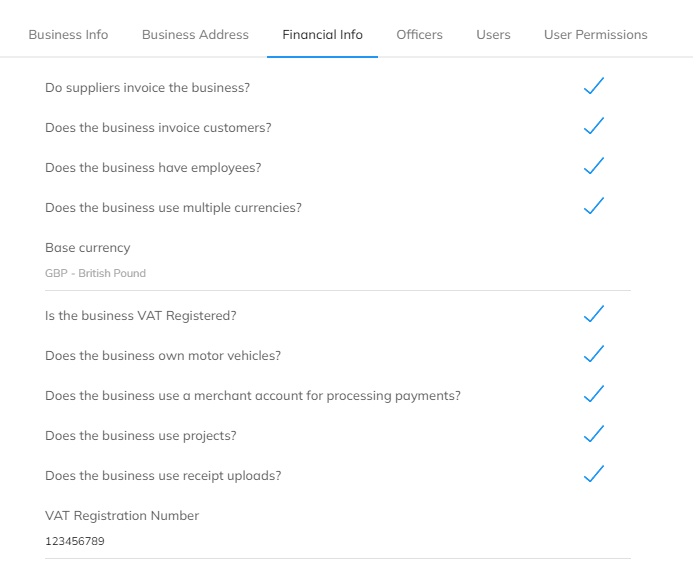

Recording your VAT number in Pandle

When you register your business for VAT, you’ll receive a unique VAT number to use on all your records. If your business is based in Northern Ireland the number will have ‘XI’ as a prefix, or ‘GB’ if you’re based in England, Scotland, or Wales.

The trouble is, including the GB or XI prefix in the VAT number settings can cause your VAT submission to fail. And honestly, who has the time for that?

To keep your VAT submissions running smoothly, Pandle will now automatically strip out the prefix if you ever enter it into your VAT settings.

You can enter or update your VAT registration number on the Financial Info tab of the Company Settings menu.

If you include the GB or XI prefix part of your registration, Pandle will automatically remove it to avoid any future errors, and display an alert to explain what’s happened.

Your VAT returns will tick along like a well-oiled machine, whilst you concentrate on growing that business. Whether you’re Goldilocks or one of the three bears, there’s always space at the Pandle table for anyone who wants easier bookkeeping.

Whether you’re registered for VAT or you’re planning ahead, start your free trial of our MTD for VAT approved software. No payment details necessary.