If just seeing the words ‘VAT’ and ‘error’ together in the same sentence is enough to send shivers down your spine, you are not alone. But fear not! Like a warm and cosy blanket, our latest update is here to help reduce the risk of any accidental mistakes causing problems in your VAT returns.

Keeping your VAT return under lock and key

Whilst nobody ever wants weird and wonderful errors creeping into their bookkeeping, mistakes can sometimes happen. For instance, submitting a VAT return and then accidentally entering transactions which are dated during the return period. It could mean there will be discrepancies in the next VAT return report you run, and nobody wants those.

It’s why Pandle includes so many error-reducing features, like our Transaction Locking tool. It’s there to act as a bookkeeping bouncer, protecting work that you’ve already done by allowing you to lock transactions within a date range, such as your VAT reporting period.

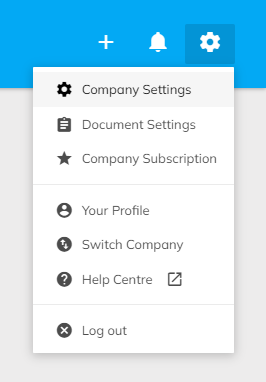

You can already lock transactions by clicking the Company Settings menu.

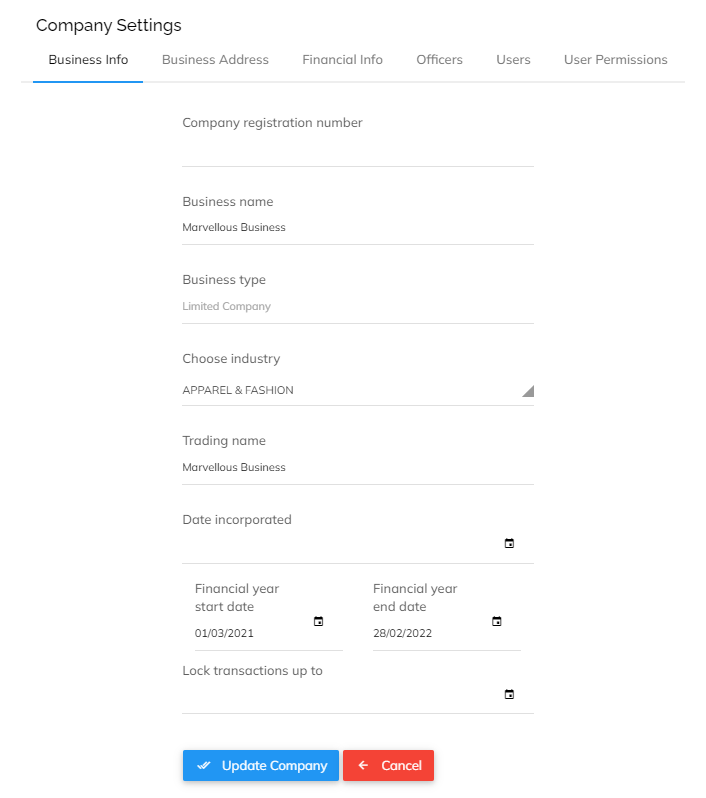

Click to the Business Info tab, and choose the date you want to lock transactions to.

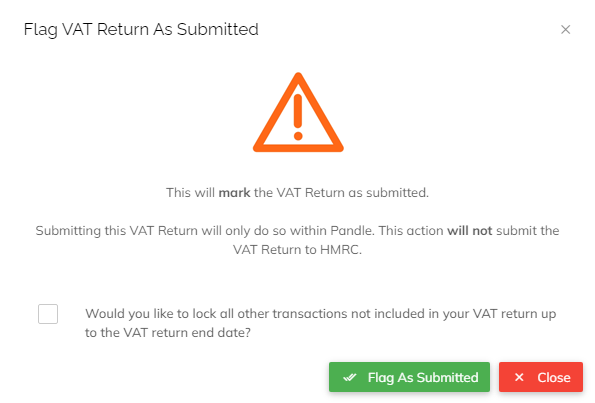

But to make sure there are as many opportunities as possible to reduce the risk of errors, our update means you’ll now be prompted to lock transactions after submitting your tax return too.

That way you have the option of locking your transactions without needing to click back through any menus, or remembering which dates to secure them until. Phew!

Avoiding errors with your VAT number

Recording the correct VAT number in Pandle will help avoid any delays or errors when you come to submit your return. The trouble is, with so much paperwork from HMRC flying about, it can be difficult to make sense of which reference number or code is which.

To help minimise the chances of entering the wrong info, Pandle will now only allow numbers in the VAT number field.

That way there’s less chance of anything unexpected happening at VAT return time. (And with Pandle keeping you up to date with your tax liability each time you enter a transaction, your tax bill shouldn’t have any surprises, either!)

Like a bookkeeping crystal ball, you’ll be able to see what’s coming with Pandle – good, clean bookkeeping with fewer errors.

Whether you’re registered for VAT or you’re planning ahead, start your free trial of our MTD for VAT approved software. No payment details necessary.