Here at Pandle we strive to make our software intuitive and easy to use for everyone. Through our range of automated features we’ve been able to effectively reduce the amount of manual effort required to complete everyday bookkeeping tasks.

Our latest feature, default tax codes, means that users can now apply a tax code to a category within Pandle. The feature automates the way in which your transactions are assigned a tax code after their category has been selected, applying the tax code to all transactions that belong to a specific category.

This means that users will no longer need to manually apply or amend tax codes when transactions falling under this category are imported.

Applying default tax codes is time-effective and reduces risk of manual error. For example, if a user imports hundreds of tax exempt sales transactions they can simply append all sales transactions to a category that has an exempt tax code set as its default.

This saves users from having to manually apply the same tax code to hundreds of transactions.

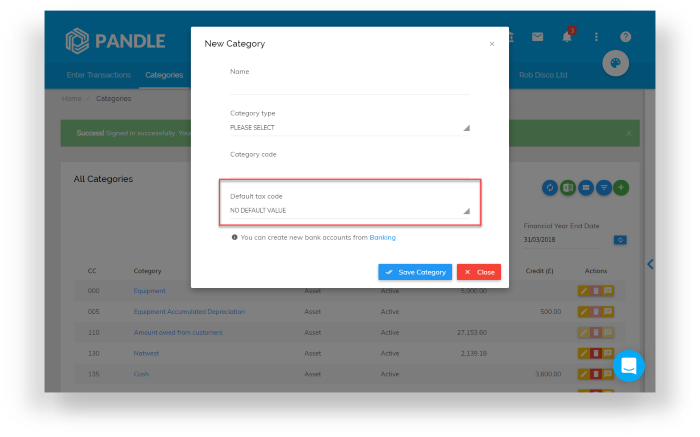

To apply a default tax code to a group of transactions, start by creating a new category. Head to the default tax code subheading, where you can then navigate to the drop down menu and select an applicable tax value – as below.

Alternatively, you can edit an existing category’s tax code, by heading over to the Categories page and selecting the edit icon to the right of your category.

By using default tax codes users can minimise repetitive, time-consuming bookkeeping tasks such as manually applying tax codes. By maximising the efficiency of these tasks our users are able to generate more time into their business.

Other considerations

Default tax codes are overruled by customer and supplier default tax codes and any Bank Rules which have been created will override them both. For example if a user enters a supplier invoice using the materials category code which is set to Standard VAT (ST) as default, but the default supplier code is set to Non VATable (NV) then Pandle will select NV as the tax code for this invoice.

Alternatively, if you want to employ more concise categorisation – users can sort transactions into categories by selecting multiple variables at once such as value, description and tax value – then the Bank Rules feature may be more effective.

Do you have an unanswered question about default tax codes? Simply head here and click the blue icon at the bottom right of the screen to access our Live Chat feature.