Shopping around for anything can be frustrating, so trying to work out which bookkeeping software your business needs can be especially confusing. At Pandle we’re passionate about making cloud accounting software that’s as easy to use as possible, so we think getting to grips with what’s what should be just as easy.

It’s why we often hear from new users who want to learn more about finding an alternative to their existing software, such as QuickFile.

Will Pandle be a good alternative to QuickFile?

Pandle and QuickFile do share a few qualities. Like Pandle, QuickFile provides cloud-based bookkeeping, and our users can access their records from anywhere (and for Pandle users this is available on their mobile, too).

Both offer a free version as well as a paid tier at a low cost; Pandle as a monthly no-contract payment, and QuickFile as a yearly fee. If you’re an existing user looking for a QuickFile substitute, then Pandle is a strong contender for both price and on range of features.

Feel less overwhelmed by business admin

You don’t need to be a bookkeeping or accounts expert – that’s what your accountant is for! Our processes are designed to reduce the amount of time you spend on admin, whilst also minimising the risk of making mistakes.

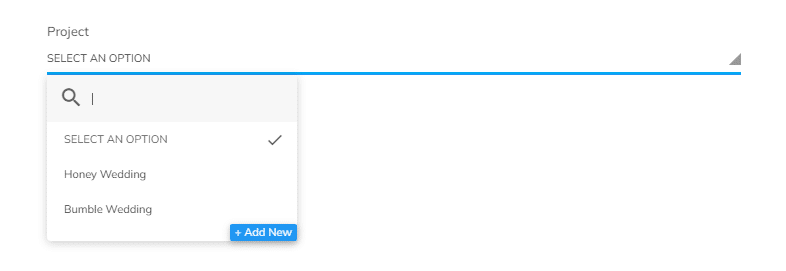

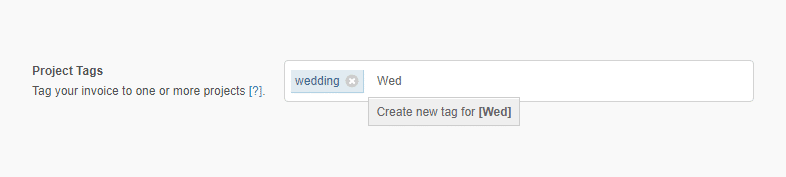

For instance, when you’re entering invoices into Pandle you can choose the correct project from a dropdown list, rather than having to type out the project name manually each time. It makes data entry faster, there’s less to remember, and less risk of accidentally creating multiple project tags for the same job. Phew!

With QuickFile you’ll need to write out your project tag manually each time you need it, even if you’ve used it before.

We develop and maintain Pandle with small businesses in mind, so you won’t feel overwhelmed by confusing menus or unnecessary features that you’ll never use, such as bank reconciliation when you use bank feeds.

But just in case, our UK bookkeepers are available on Live Chat, and our help centre articles are up-to-date and easy to follow.

Can I use Pandle for my tax return?

You can! Pandle is fully MTD for VAT compliant, so you’ll be able to manage and submit your VAT return without needing to leave Pandle or use bridging software.

How do I switch from QuickFile to Pandle?

Switching to Pandle if you were previously using QuickFile is simple. Our help centre explains how to import your existing data into Pandle in more detail, but first you’ll need to export everything from QuickFile.

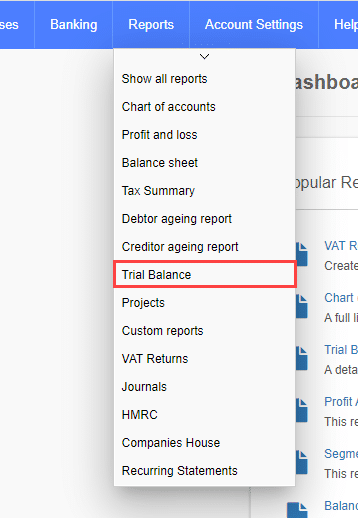

Sign into your QuickFile account, and select ‘Reports’ from the menu. You’ll be able to export the data that you need using your Trial Balance report, ready to import into Pandle and get started.

To try out our time-saving features, take Pandle Pro out for a spin. Don’t worry, we won’t ask for your bank details, and the trial period is completely free.