We know how confusing running a business can be, and that making sure your financial records are accurate can be added stress that you just don’t need. It’s why we’re releasing our latest update, to further improve the way that Pandle protects you from the risk of bookkeeping errors. Like a really helpful bookkeeping bodyguard.

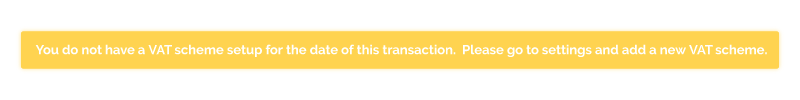

Invoice alerts for VAT

As part of this update, we’ve added a new notification message to Pandle which will help you stay on top of your VAT scheme settings.

It triggers if your VAT scheme in Pandle has ended, and you create an invoice dated after the end of the VAT scheme, which might be subject to VAT. When you click the Tax Code field, Pandle will show an alert that lets you know there isn’t a scheme set up for the date of the transaction.

It helps avoid any mistakes in your bookkeeping, and you’ll be able to update your VAT settings if you need to! Just click Company Settings from the options menu, and then select the Financial Info tab.

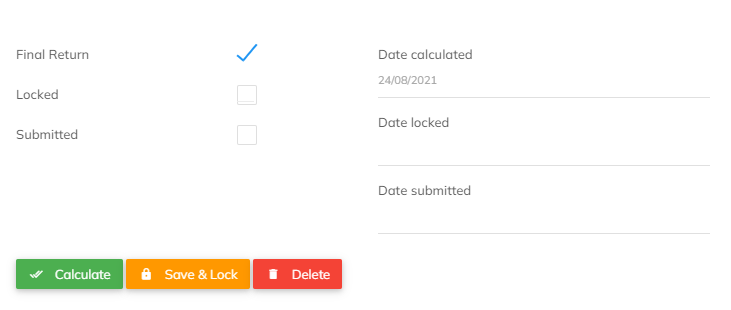

Processing transactions after confirming your final VAT return

Each time you create a VAT return in Pandle, you have the option to mark it as your final return. This is so Pandle knows that your VAT scheme is ending, and can help protect you from mistakes in the future.

We’ve tweaked Pandle so you won’t be able to create customer invoices which include VAT if they’re dated after the end of your final VAT period.

To minimise any bewilderment, Pandle will display the notification we mentioned earlier if you do try to include VAT. That way you’ll have a handy reminder to update your VAT settings if needed, and all the Pandle users in your business know what’s going on.

Avoiding tax code errors for bank rules and transactions

Creating bank rules helps you automate your bookkeeping by letting Pandle categorise transactions and assign tax codes for you

To cut down on time-consuming mistakes, Pandle will now hide the option to select a tax code when you’re creating and editing banks rules for customer receipts if your previously VAT-registered business is no longer covered by a VAT scheme.

Pandle will also hide the tax code when you’re entering transactions linked to an invoice, just to avoid any confusion.

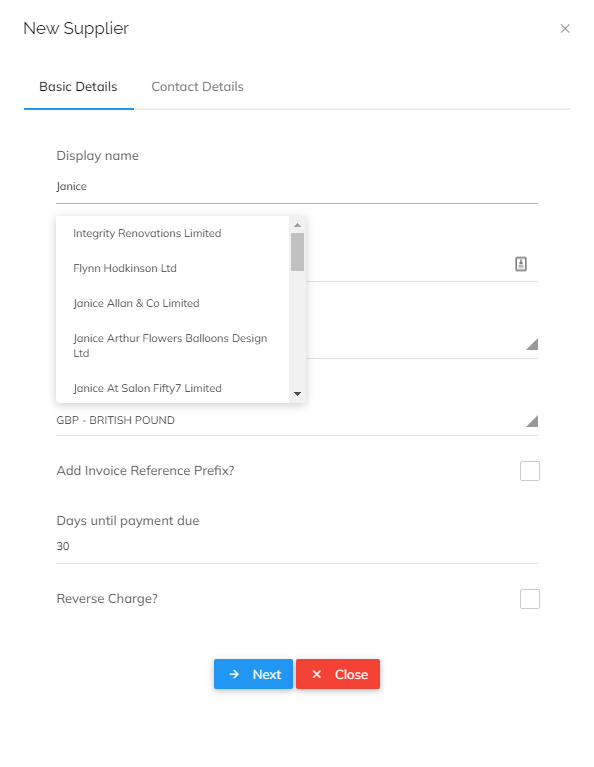

Entering company details exactly how you need them

This update also pays some attention to Pandle’s existing integration with Companies House. It’s just one of the many features Pandle has to help minimise the time you spend on data entry.

For instance, rather than typing in lots of information each time you need to create a new customer or supplier, Pandle will check for any potential matches registered with Companies House and pre-populate the information for you. That way all you need to do is select the correct option from the list of suggestions.

Our new update to the integration means that if you continue to enter the company name manually, the automatically populated fields will be voided. That way there won’t be a strange combination of information relating to different companies. One less thing to worry about!

But if you’re still worried, our team of bookkeeping advisors are available on live chat if you need them. Abseiling out of helicopters to deliver boxes of chocolates is still beyond our scope though. Sorry.

Learn more about reducing bookkeeping errors with Pandle, and create your free account.