Simplifying bookkeeping is what we’re all about here at Pandle, and as a contributor to the bookkeeping process, we know just how important credit notes are. So, when you asked us to make some changes, we got straight to work.

Sleeves were rolled up, thinking caps were put on. And as a result? Credit notes have been given a complete overhaul. Now they’re all grown up and ready for use, however you need them.

What is a Credit Note?

A credit note is essentially a negative invoice which a seller issues to a buyer, cancelling an invoice (or multiple invoices) in full, or just part of it.

You might issue a credit note if you made a mistake and overcharged your customer on the original invoice, if your customer was not happy with the product or service, or if your customer’s order was damaged or lost. You can issue them to your customers, or your suppliers might issue credit notes to you.

The Big Credit Note Update

Before our update, credit notes in Pandle were a direct reversal of an invoice and could only be applied to unpaid invoices. We knew we needed vastly expand this feature’s capabilities, so the new upgrade changes the way credit notes work in a number of ways.

Credit notes are now documents in their own right, so you’ll be able to view and print them, just like you can with quotes and invoices.

Like invoices, credit notes in Pandle will also have their own audit trail so you, so everyone else in your business, can see what’s happening and why. They’ll also show as separate entries on your VAT return.

The Main Credit Note Updates

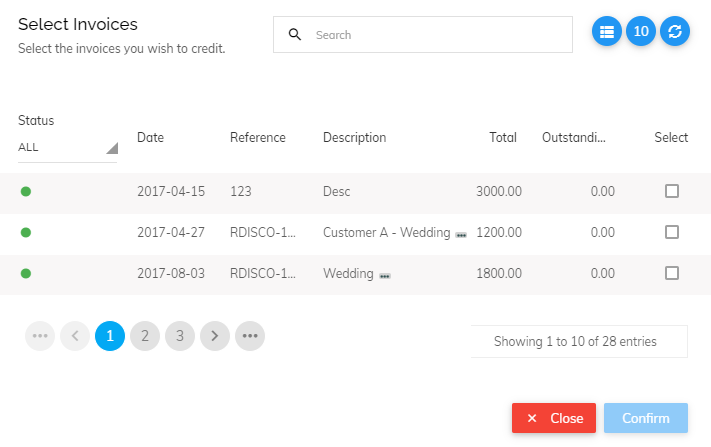

Crucially, you can now ditch any previous workarounds, and apply a credit note to invoices whether they’re paid, unpaid, or just-a-bit paid. This does mean it’s possible for your customer or supplier to have a negative balance, but that balance will automatically reduce the next time you add an invoice to the account.

You can also now apply a credit note against multiple invoices, instead of just one. This makes the process faster, easier, and much more accurate.

Using Credit Notes in Pandle

Credit notes are still accessible from your ‘Customers’ or ‘Suppliers’ screens, or by using the Quick Links menu.

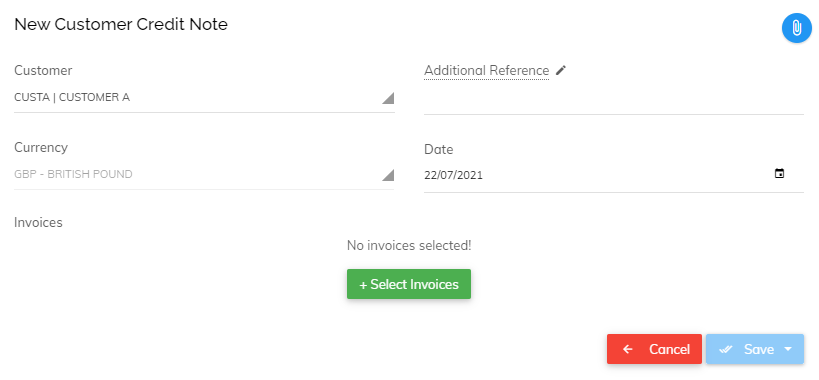

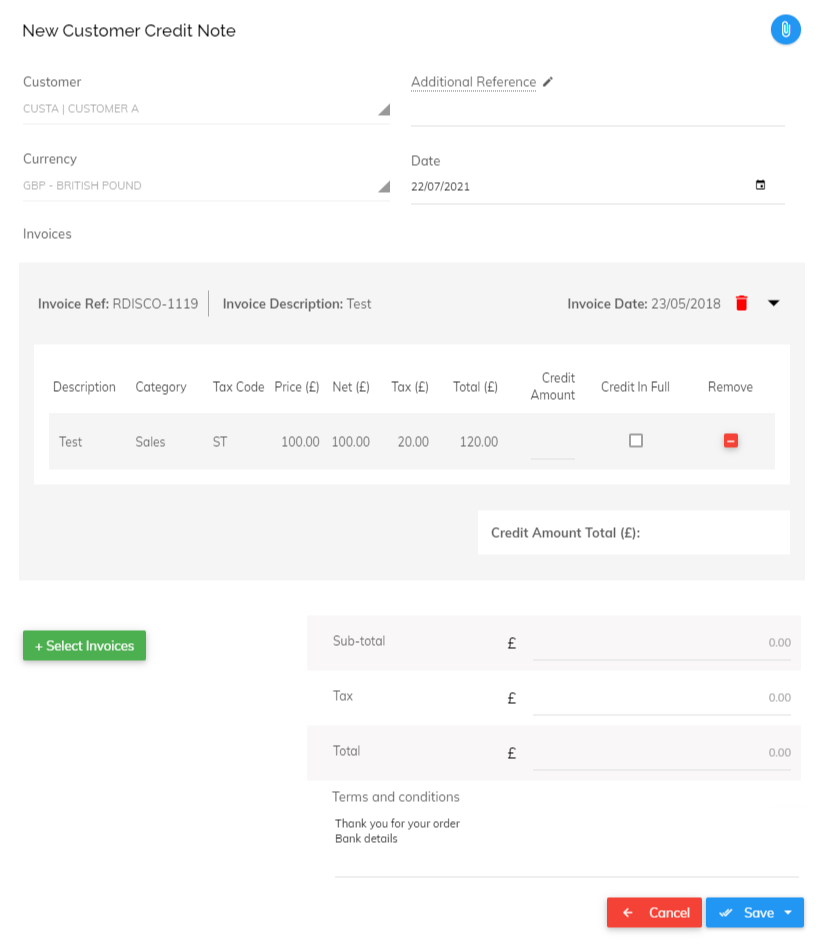

Each time you create a credit note, you’ll be asked to select the invoice (or invoices) which it relates to first. This helps Pandle make sure the correct categories and VAT treatment are used on the credit note, reducing the risk of errors.

First, select the customer or supplier that the credit note relates to, and hit the ‘Select Invoices’ button to view a list of existing invoices for them.

Then, select the correct invoice(s) from the list in Pandle, and confirm your choices.

You can treat each line of an invoice separately, applying a full credit to one line, and part credit to another. It helps you keep your records as accurate as possible, and reduces any confusion or queries later on.

You’ll now also be able to view a full list of the credit notes applied to each customer or supplier, and send and save your documents just like you do with your invoices.

Will a credit note affect my VAT return?

As credit notes in Pandle are treated as documents in their own right, they have their own date which will be included in your VAT return.

Credit notes will ‘inherit’ the tax rates from each line item on the invoice, helping you to avoid the risk of entering the wrong one by mistake. Your VAT records will be more accurate, which is only ever a good thing!

How do Credit Notes interact with the Items feature?

Pandle’s Items feature can track stock levels automatically, but issuing a credit note which includes tracked items won’t automatically update their stock level. This is because credit notes are sometimes issued when items are damaged or lost.

Instead, you can either write off those items, or revalue them if they come back in for resale. Visit our help centre for more guidance on writing-off and revaluing your items.

We’d like to play it cool, but we’re just too excited. Thanks to your feedback, credit notes in Pandle have graduated from a caterpillar to a beautiful butterfly!

Find out more about using Pandle in your business, or set up your free trial of Pandle Pro – no payment details required.