We’re big believers in automating bookkeeping processes rather than doing things manually, so you have more time for the juicy bits of running a successful business.

Features like our Payment Reminders are key to freeing up your time, but we’re aware that automating these time-saving activities also has the potential to create unwitting errors in your bookkeeping – something which shivers us to our very core.

Our latest product update helps keep the risk of those accounting errors as low as possible, so you can create and edit payment reminders in Pandle with less chance of any mistakes cropping up. Three cheers for having a sharp set of digital eyes on your side!

What are payment reminders?

In an ideal world, customers will pay the very moment they receive your invoice. We certainly try to make it as easy as possible for them with Pandle Pay!

But to help keep things on track you can create payment reminders to automate the process of reminding customers when there are unpaid invoices which need their attention.

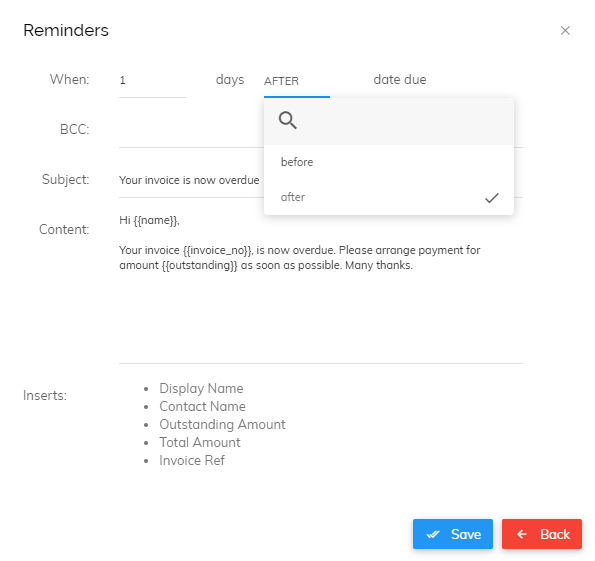

To make things as flexible as possible you can schedule these to send at intervals before the invoice due date, as well as afterwards.

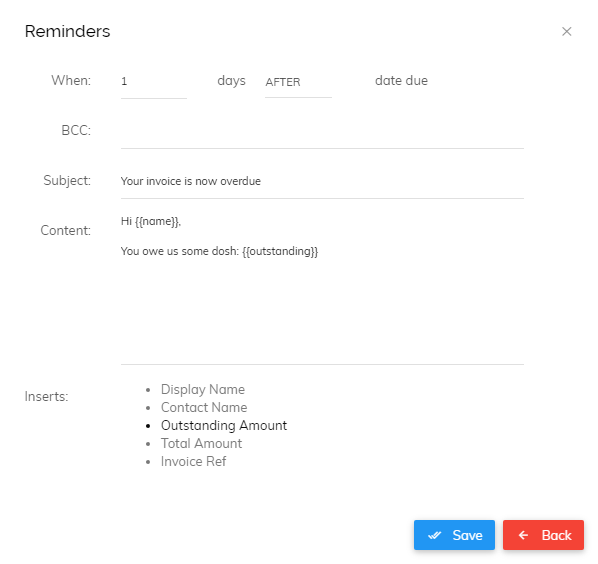

These reminders even have a customisable content box, keeping you in control of how you come across to clients – a friendly reminder or stern warning, it’s completely up to you.

How do I set up Payment Reminders in Pandle?

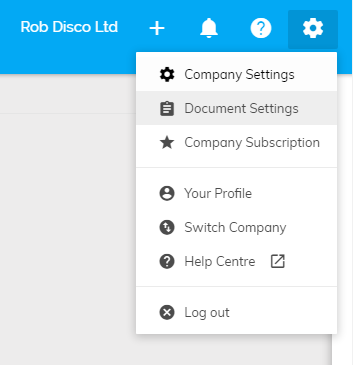

Our article about setting up automated payment reminders in Pandle explains things in more detail, but to get started, just click the cog icon on your Pandle dashboard, then Document Settings.

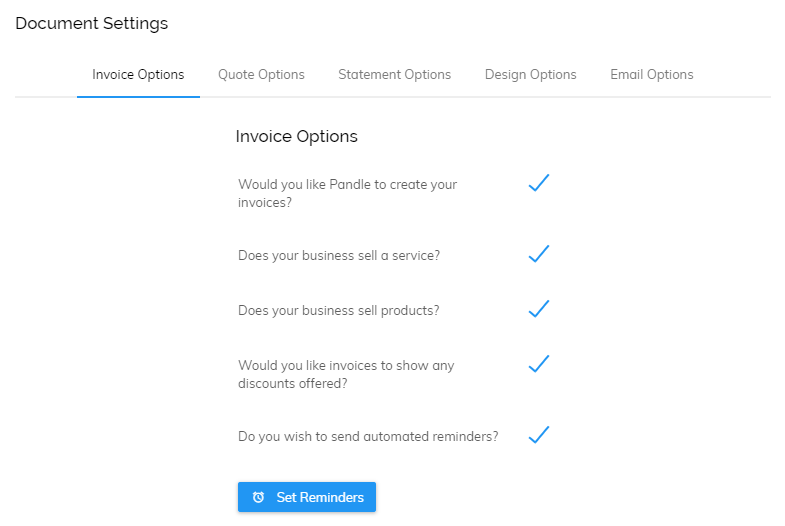

Then select the Invoice Options tab, and check the box to send automated reminders. Once you’re ready, just click ‘Set Reminders’ to edit any existing reminders, or add new ones.

Dynamically flagging potential errors in payment reminders

With greater flexibility comes the risk of making mistakes. For example, writing the amount owed by one customer in the payment reminder template, and sending it out to all your clients. I know, terrifying.

This can also cause all sorts of confusion, and quite possibly some stressful telephone calls. Fortunately, our lovely development team came up with the perfect solution!

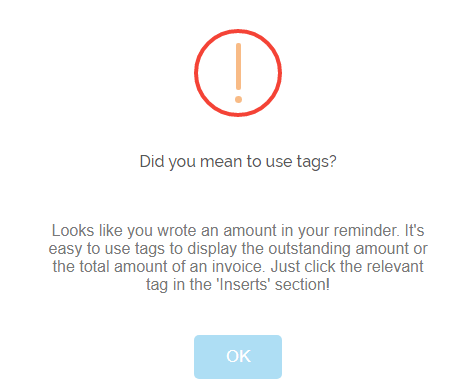

If you enter a number or currency symbol in the content field when editing or creating payment reminders, you’ll now see a prompt to double check you want to go ahead once you press save.

The alert will ask if you’d like to use tags instead of writing a specific amount into your template. Using tags allows Pandle to only pull through information relevant to the customer you’re contacting – we highly recommend this!

That way the amount is always accurate based on your bookkeeping records, and you won’t need to look anything up or have any awkward conversations!

It saves time and it helps reduce the risk of errors – now that’s a Pandle double-whammy. Guys, we’re putting this one up on the fridge.

Learn more about Pandle’s timesaving invoicing tools, or get hands-on with your free Pandle account.