If there’s one thing that we love at Pandle HQ (other than cakes and coffee), it’s making bookkeeping easier and more efficient for our users.

We want small business owners to be able to take care of their accounts with as little stress as possible. So how do we tackle bookkeeping stress? By creating accounting tools which actively help users reduce the risk of errors.

Even the smallest bookkeeping mistakes can cause big issues later down the line, and those take time to identify and fix. Time which could be spent on increasing those profits!

Which is why we have a (nearly festive) feast of Pandle product updates, all with error reduction and improved user experience in their sights.

Automatically preventing bookkeeping errors

Avoiding banking errors by restricting depreciation accounts

Adjustment entries (or journals, as they’re also known) are used when a business needs to move an amount from one category into another.

Unlike bookkeeping entries which show business transactions, adjustments are usually made at the end of an accounting period to show changes within the business. A good example of this is showing the depreciation of a business assets’ value.

The value of an asset usually reduces (or depreciates) as time passes, which affects the overall value of the business. Which means it really matters when it’s time to pay that tax bill. So, accidentally posting a banking transaction to a depreciation account? Yikes!

This is why we have now prevented depreciation categories from showing up as an option when confirming draft bank transactions. Now there’s no risk of accidentally assigning banking transactions to a depreciation account, meaning one less thing to worry about!

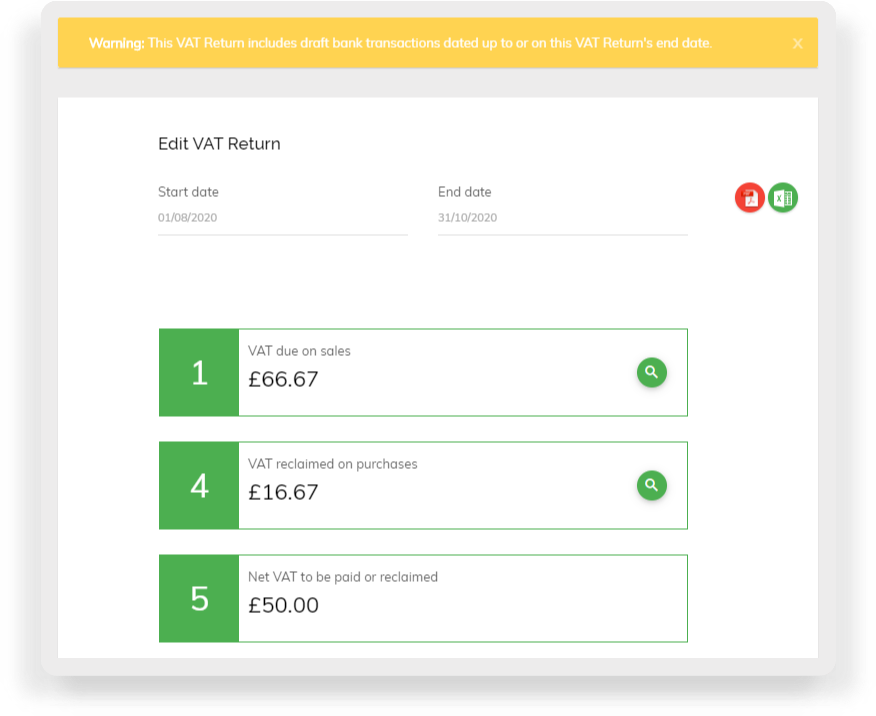

Reducing the risk of errors in VAT returns

Even just the thought of a VAT return with information missing can bring on a bad case of the horrors.

To help reduce the risk of this happening, Pandle now alerts VAT cash accounting scheme (or FRS cash accounting) users if there are any unconfirmed draft transactions when running a VAT return.

The transactions must be confirmed before completing the VAT return. That way, anything that should be included won’t get left behind, causing the VAT return to be inaccurate. Phew!

Improving the user experience

Making bookkeeping easier through the use of software means that the software must be easy to use, too. It’s why are constantly refining Pandle to make it as intuitive as possible, even for budding small business owners who are brand new to bookkeeping.

- With this in mind, we’ve enhanced the checkbox on existing attachments in our Receipt Upload feature. It makes it much clearer to see, even on darker images, and therefore much more accessible to all users.

- VAT-registered users will receive an email reminder, as well as seeing an on-screen prompt when it’s time to re-authorise Pandle for their Making Tax Digital VAT return. This way, everybody stays up to date, and users have peace of mind that their VAT return is safely submitted. Winner, winner.

We have some big updates in the pipeline, which we can’t wait to share with our users. In the meantime, we always want your feedback so that we can continue to improve Pandle’s user experience. If you’d like to share your thoughts, hit the live chat button on screen!