Even a teeny-tiny bookkeeping error can snowball into a time-consuming mess, sometimes requiring a colossal effort to resolve. As time and effort are vital resources for all small business owners, we’re constantly striving to help users focus on the areas of their business which will have the most impact.

It’s why the good folk here at Pandle HQ are constantly researching, testing, and developing our cloud-based bookkeeping software. To reduce the potential for accounting errors, whilst also improving the speed and efficiency of fixing these errors, should they arise.

So, we’re feeling pretty excited right now, because our latest update helps users quickly and easily deal with potential errors in their VAT Returns. Forgive us for any cloud-based/cloud-nine puns, whilst we explain what’s what.

Bookkeeping software for HMRC compliant VAT submissions

Thanks to Pandle being HMRC recognised software supporting MTD for VAT, our users are already able to submit their VAT returns directly from Pandle. Each time a transaction is entered, Pandle is working away in the background to calculate the corresponding VAT return, so that users feel confident about the figures being produced.

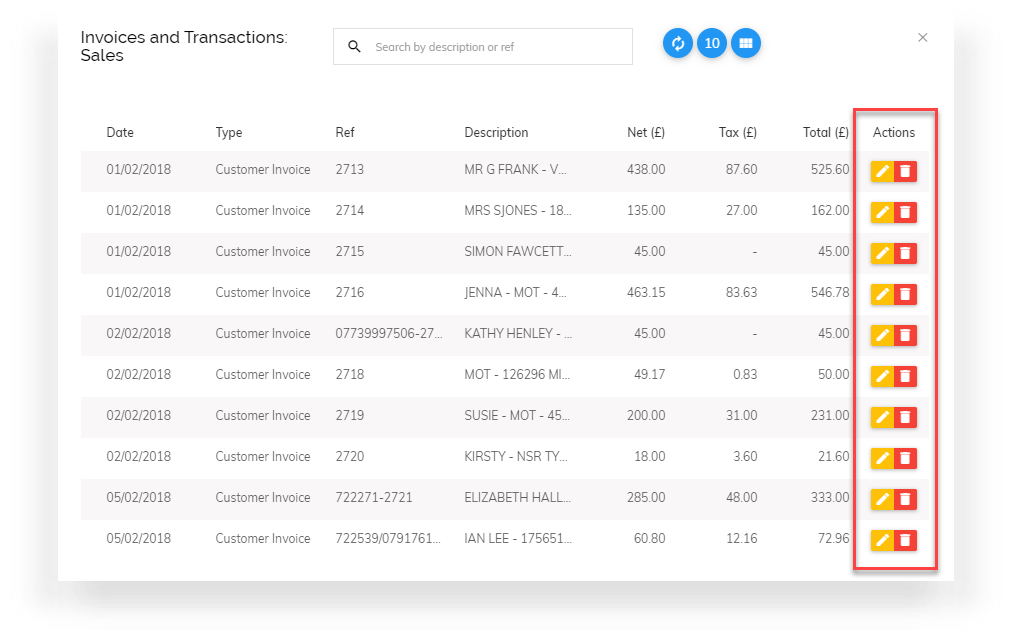

But if users were to spot a transaction in their VAT return modal that they then wanted to edit or delete, they would have had to navigate back to their View Transactions screen. Now, users can simply remove or amend the transaction right from within the VAT return modal itself.

It means that any changes to the transactions which make up a VAT return can be made much more easily, without ever having to leave the VAT returns report.

Editing and deleting transactions in VAT returns

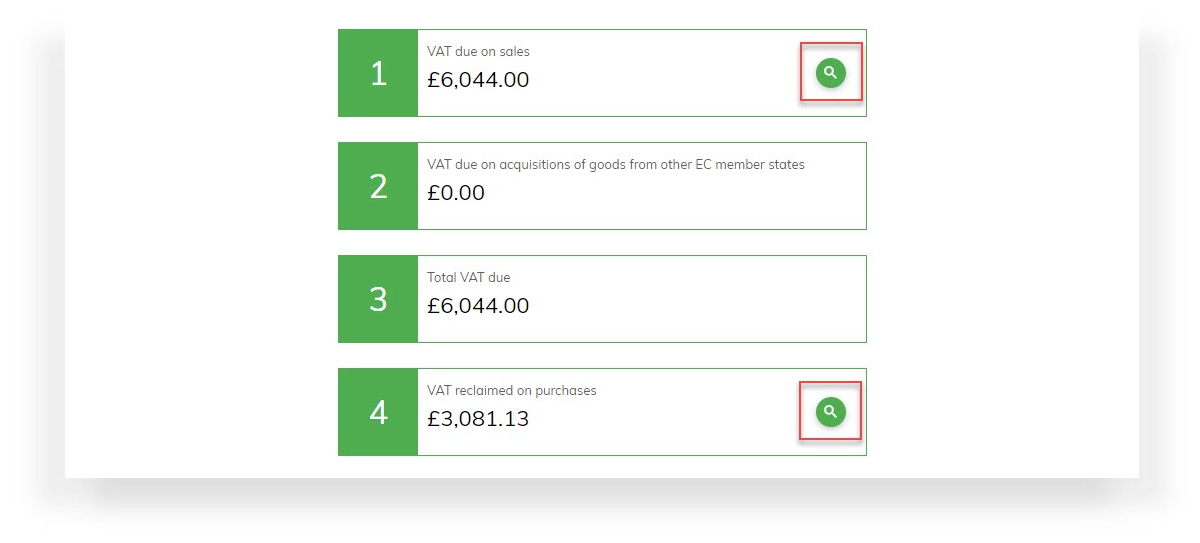

Once the VAT return report has been run, users can drill down to the list of transactions which correspond to VAT due on sales, or VAT being reclaimed from purchases. By clicking on the ‘View’ icon here:

Thanks to the new update, users now have the option to edit or delete a transaction from that list:

Another small step towards refreshingly simple bookkeeping, and without a cloud-based pun in sight. You’re welcome!

Create a free Pandle account to get started, or learn more about using Pandle with your accounting and bookkeeping clients.