Everyone makes mistakes sometimes, it’s just one of those human quirks. But when it comes to accounting, those blunders can sometimes cause all sorts of bookkeeping peculiarities. If a business owner then makes important decisions based on incorrect financial information… well. Chaos.

It’s why we at Pandle are so committed to developing bookkeeping processes which reduce the risk of human error. It’s also why we’re glad to announce our new MTD Statement feature.

What is Pandle’s MTD Statement feature?

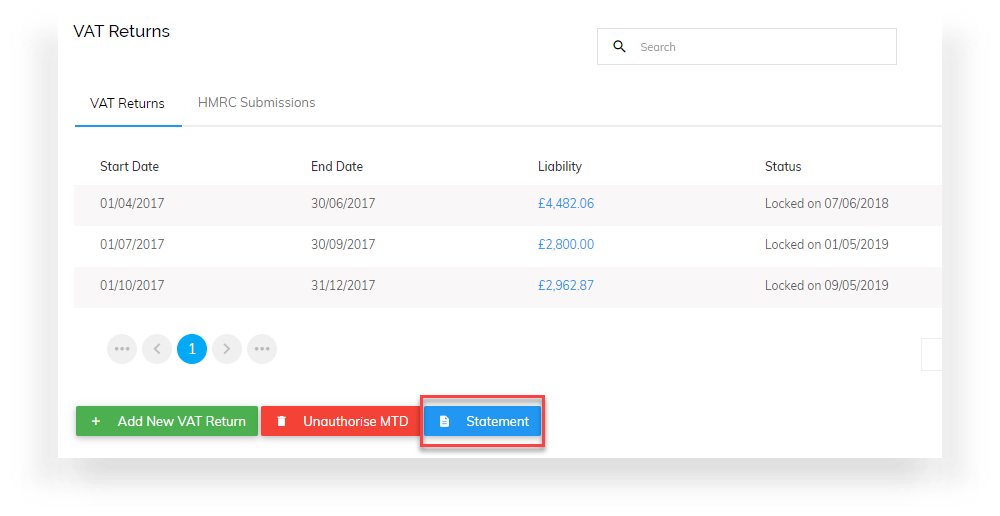

Our new feature pulls detailed information directly from HMRC into Pandle. The user-friendly MTD Statement then shows how much VAT is currently owed, as well as any payments made.

This allows users to see the exact financial information HMRC has regarding their business’ VAT affairs. To access the statement, users simply click this button from the VAT Returns page.

Reconciling VAT and MTD

Our new MTD Statement works alongside our existing VAT reports function in Pandle. Users can reconcile the VAT data pulled in from HMRC by comparing it to their Pandle account.

Doing this on a regular basis allows users to spot discrepancies as early as possible, and prevent problems from amplifying over time.

Then, when the times comes for making important business decisions, users can be more confident that the information they have is correct.

After all, reconciling accounts is the solid foundation on which good bookkeeping is built. It’s just one more step towards error-free bookkeeping!

Is your business VAT registered? Have you used Pandle for MTD? We’d love to hear your feedback!