Here at Pandle we’re on a mission to make bookkeeping as easy and error free as possible for all of our users. It’s just how we roll.

We’re always listening out for user feedback to make sure we keep adding new features, and refining existing ones, to make things as straightforward as possible. We’ve recently launched all sorts of Pandle updates, so here’s the rundown of what’s new at Pandle HQ.

Streamlined MTD process (UK Only)

Businesses who need to submit a Making Tax Digital (MTD) compliant VAT return are required to register for MTD with HMRC, but we noticed some Pandle users were authorising returns to be submitted before registering.

So, to improve the process, we’ve added a more detailed explanation and further guidance during this process, this will help users understand exactly what to do, and what order to do it in.

We’ve also added the ability to unlink your Gateway account from Pandle so you can revert back to submitting through the old method if you need to. Phew!

MTD Statements (UK Only)

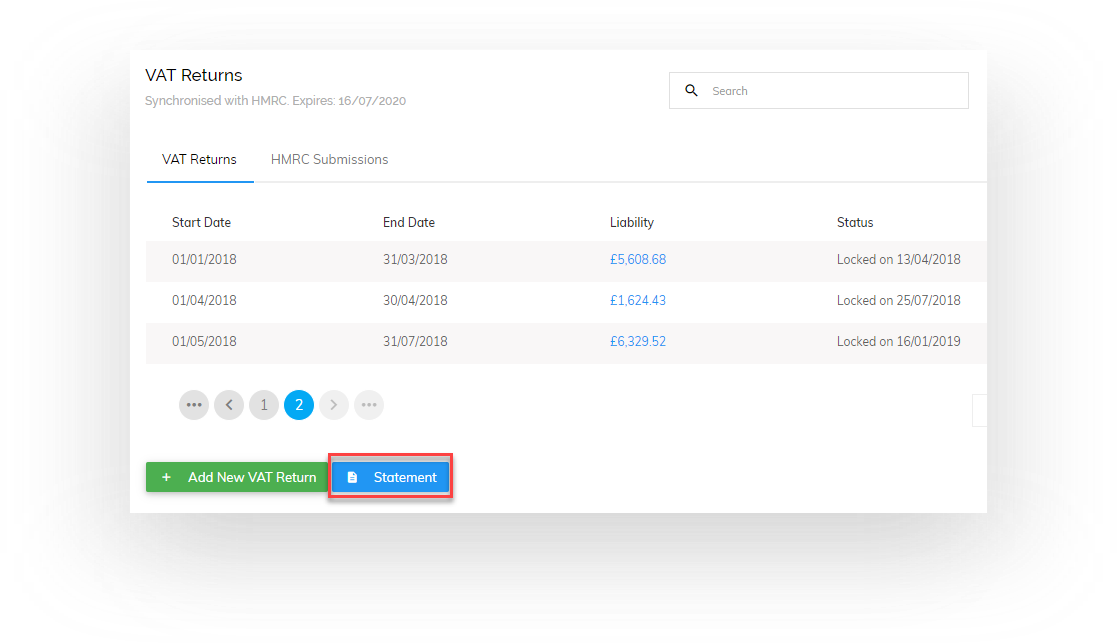

To help users keep on top of where they’re up to with MTD, we introduced MTD Statements. Hitting the Statement button under VAT Returns in Pandle will show users when their next return is due, any liabilities from previous MTD returns, outstanding payments to HMRC, and the balance owed.

MTD and our partners (UK Only)

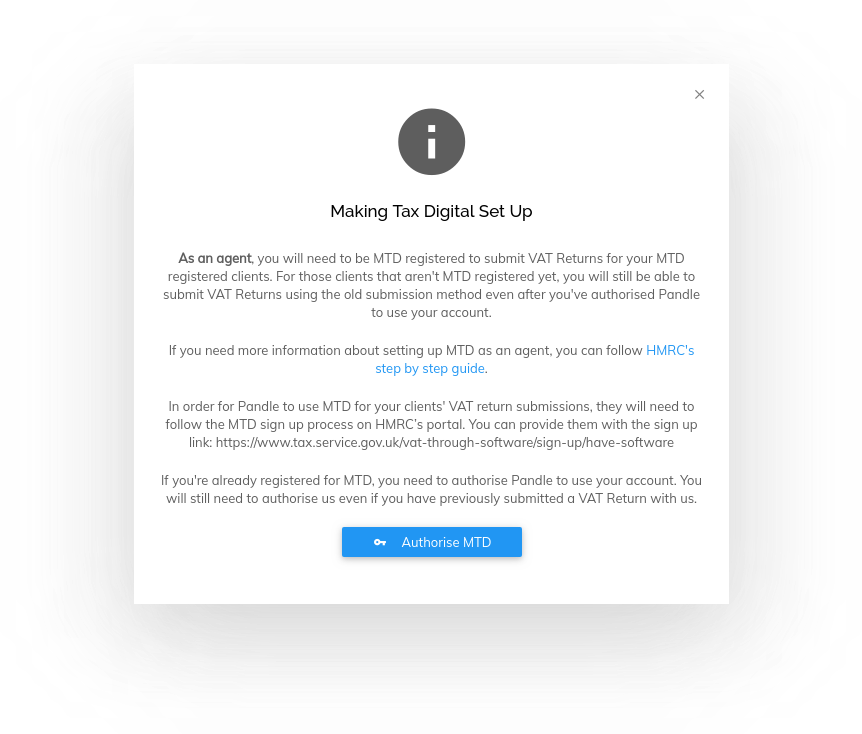

When our accounting partners authorise Pandle for MTD they are now given a full explanation of how this works, and what they need to do. We realise there had been some confusion in this area so we hope this makes life easier for everyone.

Please see the instructions below:

Our Pandle Partners are also still able to submit via the old method for their clients who are not yet registered for MTD, alongside our MTD compliant VAT submission method.

Default tax codes (UK Only)

To improve accuracy and reduce any messy inputting errors, we’ve implemented default tax codes for when users are setting up categories and processing transactions.

Exporting data

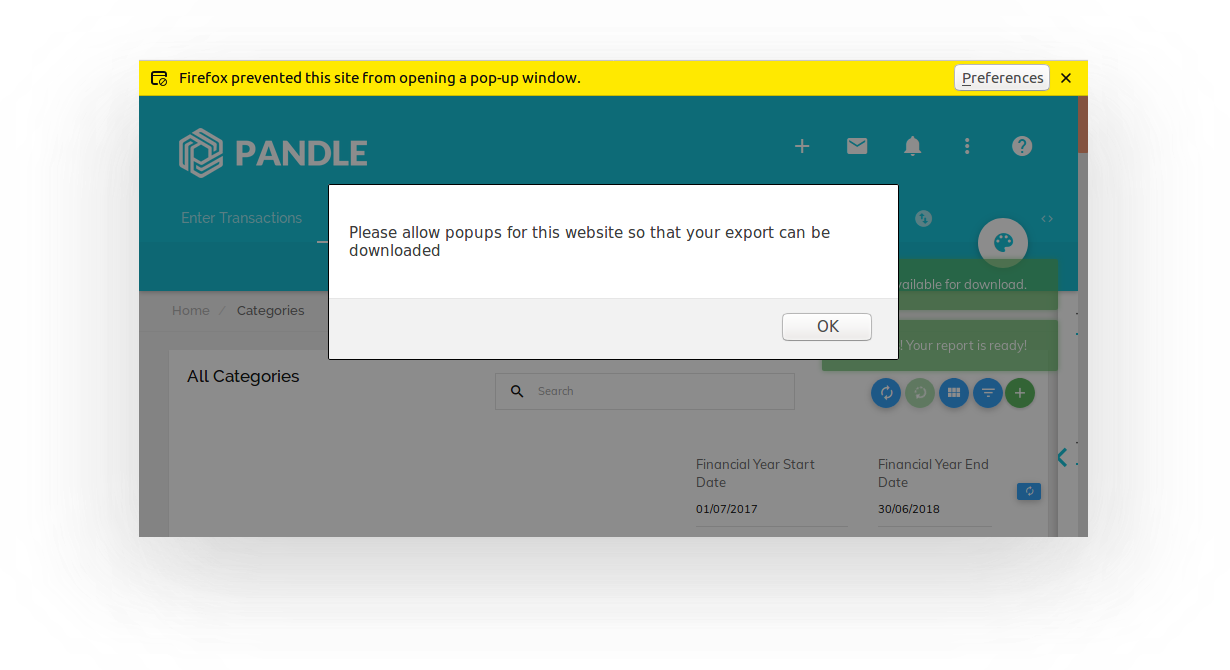

As part of our work to make Pandle as efficient as possible, many of the data exports now download as ‘background jobs’. When some users said they couldn’t see them, we went on the hunt and found that popup blockers were preventing Pandle users from downloading their exported data.

We’ve now added an alert message so that users know there’s something stopping their exports from downloading, and what to do to unleash the data goodness.

Date formats for file uploads

Sometimes you just need things done your way. We’ve updated new date formats so users have the ability to import their bank transactions exactly the way they like them, whether you’re a dd/mm/yyyy, a mm/dd/yyyy, or beyond.

If you any questions about our latest updates to Pandle then feel free to speak to one of our friendly support team on live chat or by emailing support@pandle.com.