Our cloud-based software, Pandle, allows users to collate transactions and import data easily, using automated Bank Feeds. This effectively stores data all in one place, so you can access all of your transactions at once, from any device, whenever, wherever.

But we haven’t just stopped there.

User friendly bookkeeping to save you time

Here at Pandle, we’re consistently developing our software to remain as user-friendly and as intuitive as possible. As part of our mission, we’ve updated the way you can check and confirm transactions, so now you have the option to use our latest feature, Bank Rules.

Setting up Bank Rules gives you more time to spend on your business, rather than spending it categorising and assigning tax codes to transactions. Just let Pandle do the work!

Create Bank Rules

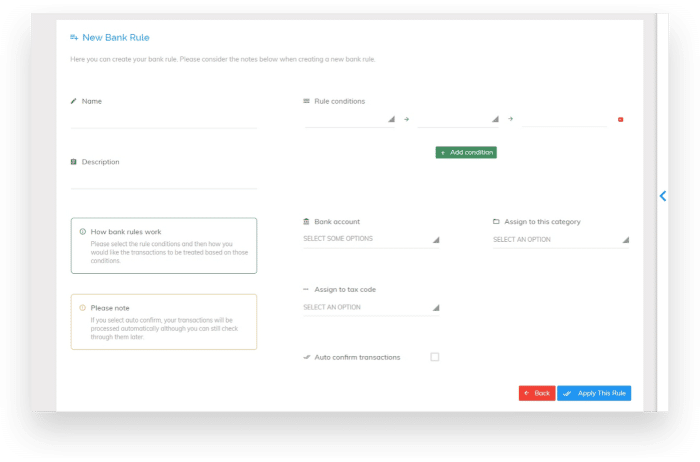

You can either create a new Bank Rule from the Imported Transactions screen or head to Tools > Bank Rules. From here, simply edit the rule conditions to change the way transactions are categorised and assigned tax codes – see below:

To give you more flexibility, you can select the rule conditions by choosing variables from the drop down menus. For instance, ‘Money In’, ‘Money Out’, ‘Equal To’ and input an amount or description. The rule you generate will then apply across your bank feed, categorising and confirming transactions correctly, whilst you focus elsewhere.

Can I create rules with multiple conditions?

Absolutely! Applying more than one condition to a rule can help you target transactions more concisely. For example, users can target a transaction based on its description and value, applying two rule conditions simultaneously: “If Money Out is Equal to £5.00 and the Descriptions contains Trainline”, Assign to Category Travel. Job done.

This will allow for multiple transactions that meet a certain value and description to be categorised and assigned a tax code.

Once applied, users will then have to check and confirm all imported transactions which follow this Bank Rule, unless they have chosen to auto-confirm these transactions when setting up their Bank Rule.

Let Pandle take care of your transactions – automatic category and VAT assignment

If you’re happy with your new Bank Rules, you can set them to work by ticking the ‘Auto confirm transactions’ checkbox whilst on the Bank Rules page. This means that when transactions are imported, you will no longer need to check and confirm them manually. They’ll be automatically categorised, assigned a tax code and confirmed based on the Bank Rule they have created.

This bespoke feature is unique to Pandle; no other bookkeeping software on the market has an auto-confirm algorithm to verify transactions for the user.

This is a particularly useful tool for accountants, who will be able to apply Bank Rules to group payments that are associated with different clients. The feature will maximise productivity, data validity and efficiency, by applying an automated feature that will instantaneously categorise and assign tax codes to transactions.

How do I know my transactions are being sorted when they’re imported?

After applying a Bank Rule you’ll see notifications in Pandle to help you clearly identify which transactions which have been confirmed by a Bank Rule, and the ones which have not. That way you won’t have to check anything manually. You can still oversee things by viewing your Automatically Confirmed Transactions, via the Confirmed tab.

You can also automatically ignore a transaction, as well as confirm one, too. So, if a transaction is cross-imported and duplicated, you can just choose for it to be auto-ignored, reducing any confusion later on.