Small business owners are feeling prepared for Making Tax Digital, but fear it will be more confusing than the current Self Assessment system, our Small Business Survey reveals.

We surveyed 1,000 small business owners in the UK and abroad to hear about their thoughts on both the UK tax process and on the impact they believe Brexit will have on their business.

Who we asked

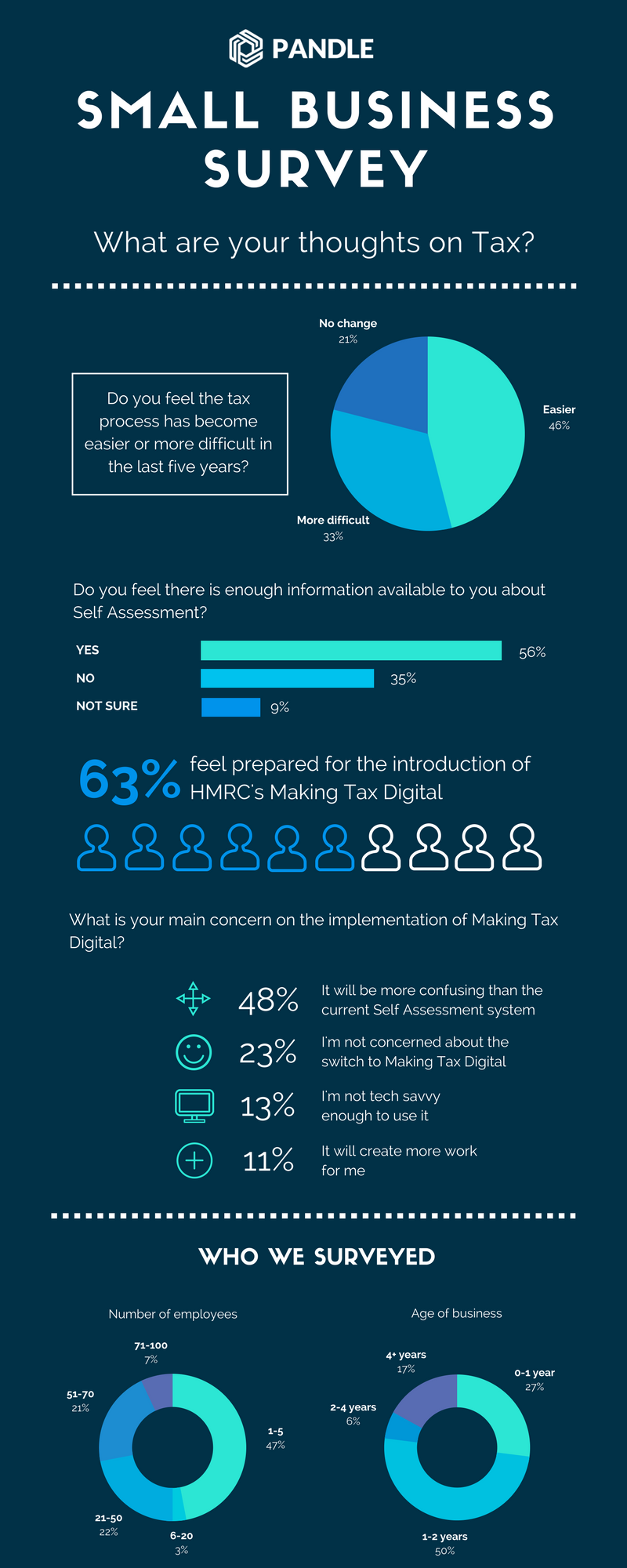

In addition to themselves, 47% of the small business owners we surveyed had 1-5 employees. 3% had 6-20 employees, 22% had 21-50 employees, 21% had 51-70 employees and 7% had 71-100 employees.

10% owned a business between 0 and 6 months old, 17% own a business that is 6 months to 1 year old, 50% of small businesses surveyed owned a business that was 1-2 years old, 6% said their business was 2-4 years old and 17% owned a business that was 4 or more years old.

A third of respondents (33%) owned a business in the healthcare industry. 12% owned a business in IT services, 10% worked in insurance and 5% owned a business in the accounting sector.

Brexit

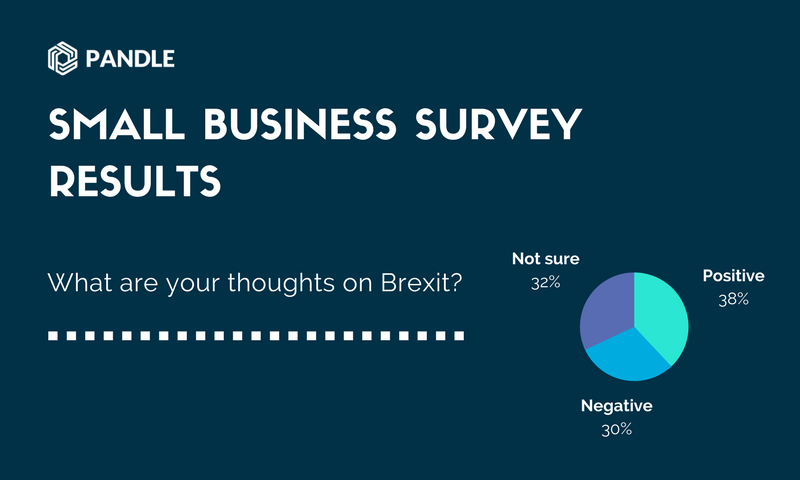

Despite uncertainty surrounding Brexit negotiations, over a third (37%) of small business owners said they think Brexit will positively impact their business. 30% said they believed it would negatively impact their small business and 33% weren’t sure.

However, small business owners were unsure about the speed of negotiations, with 47% saying they feel rushed to prepare for Brexit. 42% said they do not feel rushed and 11% weren’t sure.

Of those surveyed, 41% believed that Brexit will affect their business negotiations by creating difficulty importing from suppliers in the EU. 26% do not believe would affect their business and 20% think Brexit will mean fewer exports to the EU for them. 9% cited other reasons, including currency fluctuations and a lack of consumer confidence. 4% cited a smaller pool of talent as their main concern.

When asked if they believe the UK Government will stick to Brexit deadlines, 42% of small business owners said yes, 46% said no and 12% said they weren’t sure.

Despite doubts, the majority of respondents (61%) said they are confident in the UK Government’s ability to negotiate trade deals. 30% said they were not confident and 9% said they were not sure.

Small business owners also believe the UK Government is looking after SMEs accordingly throughout negotiations, with 56% saying they believe the UK Government is doing enough to support them as a small business owner through Brexit.

Self Assessment and Making Tax Digital

When questioned on the UK tax system, 46% of small businesses surveyed reported that they believe that the UK tax process has become easier in the last five years. 33% thought the process has become more difficult, while 21% saw no change to the tax process.

The survey found that 49% of small businesses surveyed had lost money as a result of Self Assessment submission errors. 41% had not lost money and 10% weren’t sure if they had lost money.

Despite the large number who have faced a fine, the majority (56%) of those surveyed believe there is enough information available to them about Self Assessment.

The main concern of the implementation of Making Tax Digital for small business owners is that it will be more confusing than the current Self Assessment system, with 48% citing this as their main worry.

23% were not concerned about the switch to Making Tax Digital, 13% were worried they aren’t tech savvy enough to use it and 11% believe it will create more work for them. 5% cited other main concerns, including not fully understanding the system and a higher cost in accounting fees.

Lee Murphy, Director of Pandle, commented:

“The survey does show that submissions are becoming easier to do, especially since the introduction of online filing with affordable/free software.

However, although submissions are easier the tax system is still too complex, meaning that business owners who do self-assess feel that they are not claiming for everything they could be. This is confirmed in our survey results.

So for the time being at least, small business owners should still seek the assistance of professionals for their tax affairs, no matter how easy it seems to file.”

Full Survey Report

What do you think of the results? Leave your thoughts in the comment section below.